As the year draws to a close, it’s time to start integrating tax-smart strategies into your financial plan for the upcoming tax season. Effective tax planning can help you minimize your tax burden, maximize your savings, and enhance financial success into 2025 and beyond.

This guide to year-end tax planning dives into various tax optimization strategies you can use whether your income was higher or lower than expected this year. These tax planning tips provide a solid starting point for upgrading your overall tax strategy. But they don’t replace personalized advice, so be sure to reach out to your financial advisor to learn what steps you can take to save money on your tax bill this year.

What is Tax Planning?

Tax planning involves taking a strategic approach to managing your finances by minimizing the amount of taxes owed. It involves evaluating your income, expenses, and investments to take advantage of the various tax-savings opportunities that may be available to you. The goal is not only to reduce your tax liability, but to make sure your financial decisions align with both your short- and long-term financial goals.

Approached strategically, year-end tax planning can help you retain more of your income and capitalize on tax-saving opportunities. In some situations, it may even free up funds you can use to reinvest or save toward other financial goals.

How Does Tax Planning Work?

Tax planning works by leveraging various tax incentives and deductions available under the tax code. By carefully analyzing your financial situation, it positions you to make informed decisions to maximize your tax credits and deductions, select tax-efficient investments, and reduce your taxable income by contributing to tax-advantaged retirement accounts like a Roth IRA.

For individuals, tax planning often starts by understanding your tax bracket, which is the income range that determines the percentage of your income that you owe in taxes. Tax brackets vary depending on your filing status (e.g., single, married filing jointly, head of household) and your income level and have several tiers, each taxed at a different rate. Generally, the more income you make, the higher your marginal tax rate. By knowing where your income falls within this structure, you can better gauge which strategies will benefit you most.

10 Tax Planning Strategies to Consider by Year-End

The tax strategies you implement will hinge on the tax bracket you fell into in 2024. For instance, higher-income earners may face a larger tax bill than expected and will likely be looking for opportunities to reduce their overall tax burden. Conversely, lower-income earners may have access to different tax strategies to mitigate their losses. You can find both approaches below.

1. Maximize Contributions to Tax-Deferred Accounts

Retirement savings plans such as Traditional IRAs, employer-sponsored 401(k)s, Health Savings Accounts (HSAs), Simplified Employee Pension (SEP) IRAs, Savings Incentive Match Plan for Employees (SIMPLE) IRAs, and solo 401(k)s are known as "tax-deferred" accounts. Contributions to these retirement accounts aren't taxed, and the amount you contribute is deducted from your taxable income.

If you earned more than anticipated this year, maximizing your contributions to these accounts may lower your taxable income—potentially putting you in a lower tax bracket. The downside is you'll pay tax on the distributions in retirement, but if you're looking to reduce your taxable income this year, you'll want to contribute as much as possible to these accounts. While contributions to some of these accounts must be made before December 31, 2024, contributions to others can be made through April 15, 2025, and still be counted for 2024, so make sure you consult with your advisor as soon as possible.

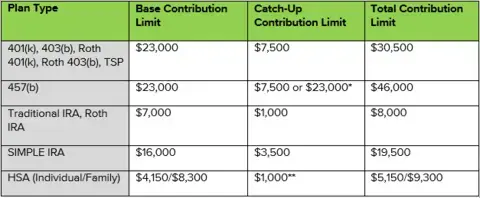

Each account type has a different contribution limit. Many employers are also willing to match up to a certain amount of your contributions to retirement accounts. By contributing at least this amount, you can grow your long-term retirement savings while minimizing your tax bill this year. In some cases, individuals over 50 can make larger “catch-up contributions” to their accounts, further reducing their taxes while continuing to save up for retirement.

Figure 1. 2024 Retirement Account Contribution Limits

* Available during the three years before the normal retirement age. Limited to the amount of the base limit not used in previous years.

** Available only to those 55 and older.

Source: Internal Revenue Service

2. Optimize Your Charitable Giving Strategy

Year-end charitable giving gives you an opportunity to support the causes that matter to you while also reducing your tax liability in high income-earning years. Charitable donations up to 60% of your adjusted gross income (AGI) are tax-deductible, while donating an appreciated asset instead of cash may help you avoid paying capital gains tax.

If you’re looking to manage charitable contributions more effectively, a Donor Advised Fund (DAF) can be a great option. DAFs function like charitable investment accounts, which you can leverage to support your favorite charity over time while receiving current-year tax benefits. After contributing to a DAF, you can immediately take the tax deduction and allow your donation to grow over time in the fund. Then, you get the benefit of recommending when funds are distributed to the charitable organizations of your choice.

Starting at age 70½, you can also start routing distributions from your retirement accounts directly to qualified charities using Qualified Charitable Distributions (QCDs). This strategy can help retirees keep their income down and can be especially beneficial once required minimum distributions (RMDs) kick in at age 73.

3. Use Tax-Loss Harvesting or Tax-Gain Harvesting

If your income is high this year, tax-loss harvesting can help you reduce your taxable income by offsetting some of your realized capital gains with realized capital losses. This strategy involves selling investments that have declined in value and using the losses to reduce the capital gains tax you would otherwise owe on investments you sold for a profit.

If you don’t have any realized investment gains for this year, you can still use tax-loss harvesting to offset up to $3,000 of your ordinary income. Further, you can carry forward the tax loss to offset gains in a future year. If you’d like to learn more, check out these six essential tax-loss harvesting tips.

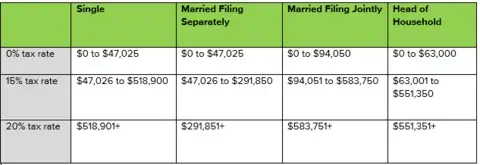

Conversely, if you’re in a lower tax bracket, tax-gain harvesting might be beneficial. This strategy involves selling appreciated assets during lower-income years, positioning you to pay little or no capital gains tax. For 2024, if you're a single individual with an income under $47,025 ($94,050 if married and filing jointly), you could pay 0% long-term capital gains tax on these sold assets.

Figure 2. 2024 Capital Gains Tax Rates by Income Level and Filing Status

4. Minimize the Net Investment Income Tax (NIIT)

Investment income is any money you earn from capital gains after selling securities or receiving stock dividends, interest from bonds, or real estate rental income. If you have investment income and your modified adjusted gross income (MAGI) is over $200,000 if single ($250,000 if married and filing jointly), you may be subject to an additional 3.8% tax due to the NIIT.

There are several tax planning strategies you can use to potentially avoid paying the NIIT. For instance, using tax-loss harvesting, you can offset investment gains with investment losses to keep your MAGI below the threshold. Some of the charitable giving tactics discussed above can also help you reduce your taxable income.

5. Bundle Your Tax Deductions

If you are close to the threshold of the standard deduction, bundling—or “bunching”—your deductions can provide significant savings. This strategy involves concentrating deductible expenses, such as charitable contributions, medical expenses, or property taxes, into a single year to exceed the standard deduction threshold. By grouping deductible expenses into one tax year, you can itemize deductions rather than taking the standard deduction, allowing you to lower taxable income during higher-earning years.

Bundling works well if your annual deductions don’t typically exceed the standard deduction, as it allows you to alternate between itemizing and taking the standard deduction each year, maximizing tax savings in the process.

6. Take All Your Required Minimum Distributions (RMDs)

If you are 73 or older, tax law requires you to withdraw a certain amount from your tax-deferred retirement accounts before the end of each year. Missing this required minimum distribution (RMD) can result in penalties as high as 25% on the amount you should have withdrawn but did not.

By meeting your RMD requirements, you can avoid those penalties and help balance your taxable income for the year, which can benefit your overall tax situation.

7. Consider Roth Conversions

Roth conversions can be an excellent long-term strategy because they move taxes from the future to the present. However, converting a tax-deferred account to a tax-advantaged account like a Roth IRA comes with a potentially hefty price tag: paying taxes on the amount you convert.

Executing a Roth conversion to “tax diversify” a portion of your retirement accounts during a low-income year or a year when your tax-deferred account has lost value may consequently be a good move. This way, you can pay taxes on the lower asset value in the account while potentially taking advantage of a lower tax bracket.

For example, imagine you're typically in the 24% tax bracket, but this year, you're in the 22% tax bracket. Suppose you convert enough of a tax-deferred retirement account into a Roth account to "fill up" the 22% bracket. In that case, you will gain relative tax benefits compared to executing the conversion in a typical year.

8. Exercise Some Stock Options

If you earn a portion of your income as equity, it may be beneficial to exercise some stock options before the end of the year, but timing is crucial to avoid unnecessary taxes. Your decision will also hinge on the type of equity you receive: statutory stock options, such as incentive stock options (ISOs) or stock from an employee stock purchase plan (ESPP), or non-qualified stock options (NQSOs). These two classes of options have different tax implications.

For ISOs, exercising early and holding the shares for more than a year can qualify you for long-term capital gains treatment. On the flip side, when you exercise NQSOs, the difference between the grant price and the exercise price is taxed as ordinary income. By evaluating your overall income for the year, you can determine whether it makes sense to exercise some of these options.

No matter what type of stock option you've been offered, creating a multi-year plan to balance the cash flow and tax implications from exercising those options will help set you up for long-term success. You'll want to review your stock holdings periodically to manage your concentration risk when actioning that plan. The year's end can be the right time to ensure you haven't unbalanced your risk portfolio by exercising your stock options.

9. Employer Stock in Your 401(k)? Remember NUA

If a current or former employer offered you a compensation plan that included shares of company stock through an ESPP or 401(k), a net unrealized appreciation (NUA) strategy could be beneficial. For tax purposes, these shares have two parts: the cost basis, or what you paid for the stock, and the appreciation, which is how much the stock has risen in value since you purchased it.

Normally, distributions from 401(k)s are taxed as regular income, which can be a high rate. If you follow the NUA rules and requirements, you can pay the more favorable capital gains tax rate on the appreciation of your employer stock. You'll still have to pay income tax on a cost basis, but you can achieve a tangible tax benefit through clever arrangements that account for the other rules of NUAs.

10. Defer Your Bonuses and Income

Some employers may allow you to defer your salary or bonus to the following year. If you think this year's income might be higher than next year's, working with your employer to take advantage of a deferred compensation strategy may allow you to sequence it efficiently.

It’s Never Too Early to Get Ready for Tax Season

No matter how your income fared this year, there are always short-term opportunities you can leverage to set yourself up for long-term success. If you still have more questions, don't hesitate to reach out to our team of financial advisors and tax specialists—we're here to help!

Advisory services offered through Wealth Enhancement Advisory Services, LLC, a registered investment advisor and affiliate of Wealth Enhancement Group®. Wealth Enhancement Group is a registered trademark of Wealth Enhancement Group, LLC.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA. Investing involves risk, including possible loss of principal.

#2024-5928