Long-term care (LTC)–sometimes called extended care–describes the care an individual needs if they can no longer perform basic daily routines (eating, bathing, dressing, etc.) on their own due to preexisting conditions, disabilities, or frailty. Services that provide this type of care can include adult day care, a home health aide, assisted living or a nursing home.

The need for extended LTC can quickly deplete your assets and their ability to generate income. However, having a fine-tuned financial plan that includes a strategy to pay for LTC can prepare you for a life-changing event.

Who Needs LTC?

Thanks to medical advances, people are living longer. That’s good! But the longer you live, the likelier it is that you’ll require LTC. In fact, 7 out of 10 people will require long-term care in their lifetimes.

- 8.3 million–Number of people in the U.S. who received some form of LTC in 2016

- 52%–Percentage of people who turn 65 today that will develop a severe disability and will require LTC at some point

- 2 years–Average length of time, over a lifetime, that a person will require LTC

As you can see from these numbers, a significant percentage of the population will require LTC. No one likes to discuss these kinds of issues, but it’s in your best interest to factor extended care into your post-retirement plans. That way, you’re covered if you need it.

Effects on Nonprofessional Caregivers

While it’s common (and sometimes expected) for friends or family members to provide care services, this can come with unintended consequences. The following numbers show the types of physical, emotional and financial strain that nonprofessional caregivers may face.

- 52%–Percentage of caregivers who don’t feel qualified to provide physical care

- 70%–Percentage of caregivers who have to take time off work

- $10,423–Total average out-of-pocket expense for caregivers

That’s not to say the experience of providing care services for a loved one can’t also be rewarding. The important thing to remember is if your long-term plan is to have a family member care for you, make sure they know it. The lines of communication should be open, and everyone needs to be on the same page.

Average Costs of LTC

The cost of long-term care depends on a number of factors including the type of care you need, where you live and how long you need care. Figure 1 below shows the average annual cost for three types of care in the U.S.

Figure 1: Realities of Long-Term Care Costs

Source: Genworth Cost of Care Survey

According to Genworth, there are three different types of LTC, and each one is dependent on the needs of each individual. As you can see, the costs of these services can add up:

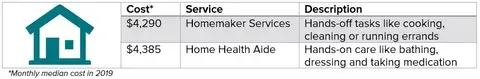

In-Home Care

In-home care provides regular assistance to help you with your basic daily tasks, and it allows you to stay in your home for as long as possible.

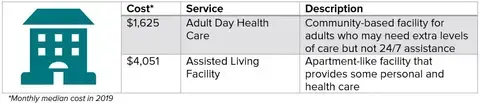

Community and Assisted Living

For individuals who don’t need the level of care available in a nursing home but who can’t–or don’t want to–maintain their own home, community and assisted living programs can be a good option.

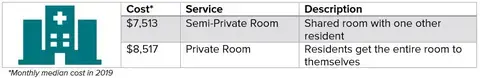

Nursing Home Facility

Nursing home facilities are for individuals who need access to around-the-clock personal and health care services.

These costs have risen considerably over the last several years, and they’re projected to continue rising significantly in the years to come. Without careful planning, your retirement savings may not be able to cover all these costs.

Paying for LTC

Medicare–while available for people age 65 and over and/or those who receive Social Security Disability benefits–does not cover most LTC services or personal care if you are chronically ill or just need help in your old age. However, if you are hospitalized and need to recover in a skilled nursing facility, it will pay for a portion of the care needed to recover (i.e. you fall and break your hip and need to stay in bed and then have intensive physical therapy). In these instances, Medicare can help.

So, how are you supposed to pay for LTC? Long-term care insurance is a good option, as it can reduce the amount of out-of-pocket costs you have. However, it’s important to plan ahead and start looking into it while you’re still healthy–around age 50. Any earlier and you’re paying for coverage you don’t need for a long time. Later, and your rates could skyrocket. Plus, your ability to qualify for LTC insurance is dependent on your health, and your chances of qualifying drop considerably as you age.

The need for LTC is a reality that many–if not most–of us will experience in our lifetimes. Depending on your needs, it can get expensive, so it’s important to start planning now. Set up a no-obligation call with a financial advisor today to see how you can better prepare for the future.