Everyone needs a plan for their long-term care (LTC). According to the U.S. Department of Health and Human Services, an average of 70% of people 65 and older will need long-term care at some point in their lives. Many people choose LTC insurance as part of their long term care plan, but most don’t. According to the Institute on Aging, 65% of those needing care will rely exclusively on family and friends to provide assistance.

No one enjoys discussing end of life issues, we get it. And few financial products are as confusing as LTC insurance can be, but LTC insurance can help protect your nest egg from the rising costs of long-term care. So instead of focusing on the negative, consider the peace of mind that LTC insurance could provide you and your loved ones.

It’s important to find the right policy for you and your situation. We recommend you consider these three factors as you consider your options.

When Do You Want Your Long-Term Care Insurance to Start?

One question to ask yourself is this: Do you want your care to start right away when you become eligible or wait a certain period of time? Many plans include a “waiting,” “elimination” or “deductible” period, which is the amount of time before a LTC policy will begin paying benefits and acts as a deductible.

If you choose a plan with a waiting period you can expect lower premiums than plans with no waiting period. And, the longer the waiting period the lower your premiums. For this reason, some people opt for a plan with a waiting period before LTC insurance to kicks in. If you choose this option, be sure you have funds set aside to pay for the first 30, 60 or 90 days of care.

How Much Long-Term Care Insurance Do You Need?

Unfortunately, there is no magic formula for deciding how much coverage to purchase; everyone’s situation is unique. That said, there are factors that will help decide how much is right for your particular situation.

Do you have a history of longevity in your family? Has anyone else in your family previously needed long term care? If so, you’re more likely to need LTC and this may help determine how much to purchase.

Are you thinking about self-insuring? A cost sharing strategy may work best for you. Depending on your unique situation, you may choose to purchase some coverage and pay the rest out of pocket.

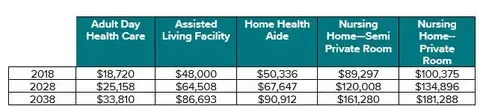

Another important factor to take into account is your geographic location and the type of LTC you will need. Costs range significantly by type of care as show in the Median Cost of Care table below. Costs also vary by location with but tend to be higher in metropolitan areas. When deciding how much coverage to purchase, you will want to take into account the general cost of services in your area.

Annual Cost of Care: National Medium

Source: Genworth Cost of Care Survey 2018. Projects for 2028 and 2038 costs calculated based on 3% annual Rate of Inflation.

Don't Forget to Purchase Inflation Protection

Purchasing LTC insurance without inflation protection is like purchasing a bag of ice and not putting it in the freezer—eventually it will melt away until there is little to nothing left.

When you purchase LTC insurance you are taking into account your future. Because you may wait 10-20 years before tapping into your policy, you will want to ensure your benefit keeps up with the rising costs of care. As you can see in the above table, annual cost of care will likely increase substantially by the time you actually use it.

While many policies may offer more than one option, a 5% inflation rider is often seen as the “gold standard.” Some consumers are moving to a 3% compound inflation factor in order to get more affordable premiums; inflation riders often account for about 50% of your premium. Whatever the size of the inflation rider, adding one will help ensure your benefit will keep up with the rising costs of care in the future and will alleviate pressure on your family members.

When to Purchase Long-Term Care Insurance

If you’re in your 50s or 60s, you should start considering this type of coverage. Purchasing LTC insurance while you are younger can ensure that you receive the best benefit at the lowest cost, but it is never too late to consider this type of coverage.

Talk to your advisor to see how LTC insurance can fit into your comprehensive retirement plan. LTC insurance does not have to be overwhelming or daunting. Doing your research, knowing what questions to ask and taking the time to understand this coverage can help you become a smarter consumer and ensure you are purchasing a policy that is right for you.

This article contains only general descriptions and is not a solicitation to sell any insurance product or security, nor is it intended as any financial or tax advice. For information about specific insurance needs or situations, contact your insurance agent. State insurance laws and insurance underwriting rules may affect available coverage and its costs. Guarantees are based on the claims paying ability of the issuing company.

Riders are additional guarantee options that are available to an annuity or life insurance contract holder. While some riders are part of an existing contract, many others may carry additional fees, charges and restrictions, and the policy holder should review their contract carefully before purchasing.