The Securing a Strong Retirement Act, aka SECURE Act 2.0, is the latest retirement bill moving its way through Congress. It passed in the House of Representatives on March 29 in a sweeping 414-5 vote and is now awaiting approval in the Senate.

If the bill passes into law, a major change will once again be made to the timing of when retirees need to begin taking required minimum distributions (RMDs).

What Are RMDs?

The IRS mandates that owners of a qualified retirement savings account such as an IRA or 401(k) must begin taking distributions out of those accounts at a certain age. These distributions are called RMDs. Remember, the deal we make with the IRS to save into these tax-qualified accounts is as follows:

- We receive tax-deferment of earnings and growth, plus a tax deduction, for contributions saved into them today.

- The IRS calls the shots on when we are required to take money out in the future. Every single penny distributed from a qualified retirement account is fully taxable as ordinary income.

As an aside, this is why saving into multiple types of accounts (i.e. tax preferential and tax-free) is so critical for your future. The more diversified your savings are based on tax status, the less control the government and potential tax hikes will have over your income in the future.

What Is Changing as Part of the SECURE Act 2.0?

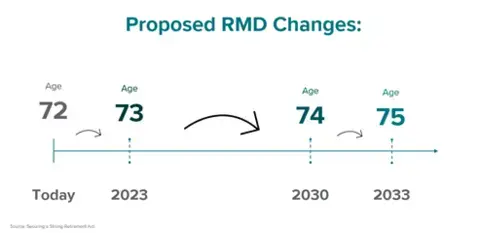

The current RMD age today is 72, as established by the SECURE Act from December 2019. The SECURE Act 2.0 would increase the RMD age from 72 to 75 in a few stages over a period of 11 years:

- In 2023: Increase RMD age from 72 to 73

- By 2030: Increase RMD age from 73 to 74

- By 2033: Increase RMD age from 74 to 75

What You Can Do

By pushing out a retiree’s RMD age, the IRS gives qualified savings account owners more time to implement tax reduction strategies like qualified charitable deductions (QCDs) and Roth conversions. If done properly, these strategies can reduce your tax burden both today and in the future.

Statistically speaking, income taxes are the largest household expense retirees are burdened with—besides health care. This makes retirement income and tax planning more important than ever.

As mentioned above, this bill has not yet been enacted into law. But the frequency with which retirement distribution rules are increasing in complexity is making it harder and harder for retirees to keep up with the changes. Reach out to a financial advisor to learn more about what you can do to stay ahead of the changing retirement landscape.