Written by Tara Mier

For many Americans, owning a second home in a beloved vacation spot is more than a dream — it's a sign they've made it. From ski retreats in Colorado to summer cottages on Cape Cod, these seasonal homes are reshaping the housing landscape in dozens of counties across the country. And with mortgage rates projected to decline in 2025, the window may soon open for more people to buy a slice of their favorite escape.

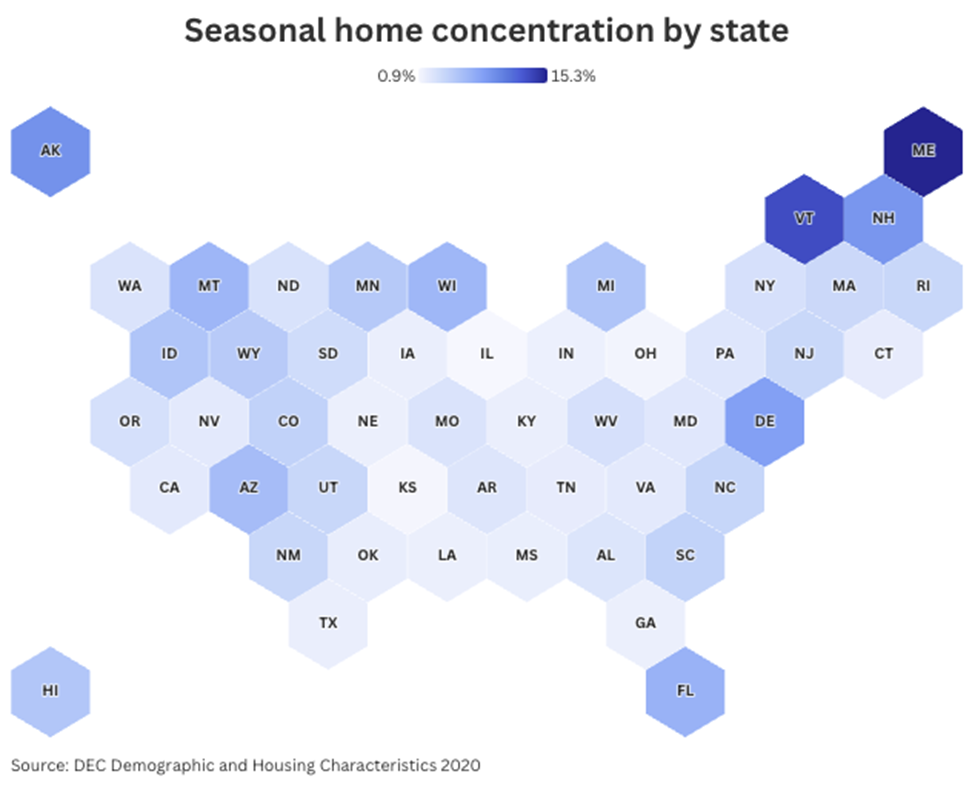

A 2023 U.S. Census Bureau analysis of 2020 housing data shows that more than 4.3 million homes were classified as “vacant seasonal,” making this the largest category of vacant housing nationally. Using this data, along with housing price data from the National Association of Realtors, Wealth Enhancement mapped where vacation homes make up the highest share of housing and examined the economic ripple effects in these markets.

America's vacation home market by the numbers

Seasonal homes are not a fringe market — far from it. According to the Census, seasonal housing units are the largest component of the nation's vacant housing inventory. They are heavily concentrated in coastal and mountain regions, where natural beauty, recreational opportunities, and rental demand intersect.

- In 645 out of 3,143 U.S. counties, seasonal homes made up at least 50% of all vacant units.

- Maine leads all states with 15.3% of homes classified as seasonal, followed by Vermont (13.2%) and Alaska (9.1%).

- Nationally, the second-home stock reached 6.5 million properties in 2022, or 4.6% of all homes.

- Florida stands out with 1 million second homes, making up over 15% of the national total.

Top vacation home counties: Where demand concentrates

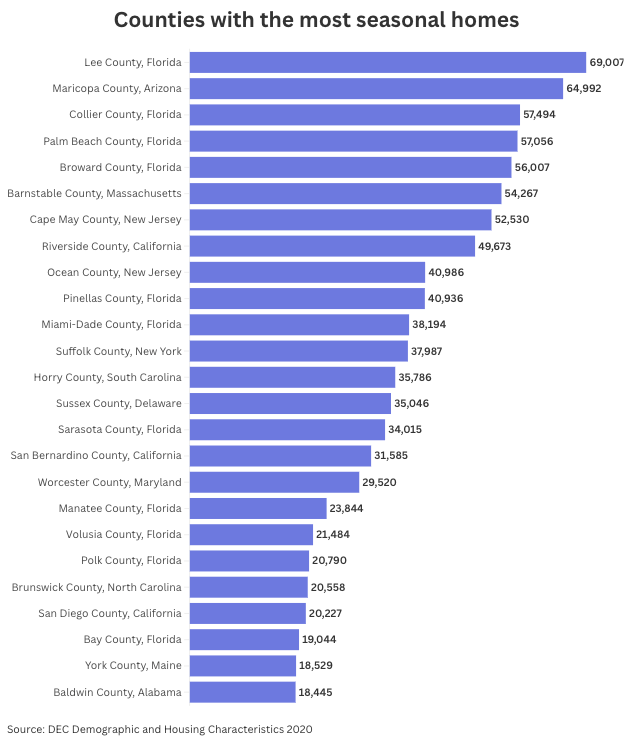

Focusing on counties with at least 5,000 total housing units, the data reveals which destinations are true second-home hotspots. These places attract seasonal residents for their scenic beauty, strong rental markets, and well-developed vacation economies.

- Lee County, Florida: 69,007 seasonal homes, making up 17% of total housing; median price at $247,000

- Barnstable County, Massachusetts: 54,267 seasonal homes, making up 33% of total housing; median price at $475,000

- Collier County, Florida: 57,494 seasonal homes, making up 25% of total housing; median price at $314,000

- Dukes County, Massachusetts: 7,747 seasonal homes, making up 44% of total housing; median price at $1,400,000

These numbers are based on 2020 Census data and National Association of Realtors home price data.

Colorado's ski counties and Michigan's lakefront areas also rank high, as do parts of the Pacific Northwest. In these areas, second homes can comprise a significant portion of the housing market, especially in small counties where seasonal population shifts are more noticeable.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

Economic impact: How seasonal demand shapes local markets

Seasonal housing brings unique dynamics to local real estate markets. Unlike primary residences, vacation homes are subject to more pronounced seasonal price fluctuations and can limit inventory for full-time residents. According to Investopedia, seasonal trends can drive 5% to 10% swings in home prices depending on the time of year.

Local economies, meanwhile, often rely on these properties for tourism revenue and jobs. On Cape Cod, for instance, second homes make up 37% of the housing stock. Boston 25 News reported that since 2021, the number of rental property owners there has jumped 48%. Aspen, Colorado, sees economic activity year-round thanks to its status as a resort and arts and culture destination with demand for home maintenance, rental management, and hospitality services.

Interest rate impact and 2025 market outlook

Interest rates may make vacation homeownership more accessible again. Morgan Stanley projects that the 30-year mortgage rate, which sits at 6.77% as of June 26, could fall to as low as 6.25% by late 2025. A 0.75% drop would cut payments on a $1 million mortgage by about $400 per month, significant for buyers weighing the cost of a second property.

Rate changes uniquely affect vacation home sales, since these purchases are often discretionary and require larger down payments. If rates decline, many high-income buyers may see 2025 as the ideal time to lock in their dream destination home.

What draws buyers to prime vacation destinations

The appeal of vacation home markets goes beyond aesthetics. These places tend to offer:

- Scenic amenities like beaches, mountains, or lakes

- High rental income potential during peak seasons

- Proximity to urban areas for weekend getaways

- Strong resale value and long-term price appreciation

- Established infrastructure to support tourism and seasonal living

Whether it's for investment, lifestyle, or legacy, owning a second home remains a powerful aspiration and a market force to watch.

Conclusion

Seasonal homes are transforming real estate markets across the U.S. With over 6 million second homes already in circulation and interest rates poised to dip in 2025, the appetite for vacation properties may soon grow even stronger. For would-be buyers, knowing where these homes concentrate — and how they impact local economies — can help identify the best opportunities for long-term value and lifestyle enjoyment.

This story was produced by Wealth Enhancement and reviewed and distributed by Stacker.

#2023-8612