The Social Security program allows you to start receiving benefits as soon as you reach age 62. But you can also defer up until age 70 and receive higher benefits. How do you decide the optimal time to take your benefits? Here are a few things to consider when making your decision.

Understanding Your Social Security Benefits

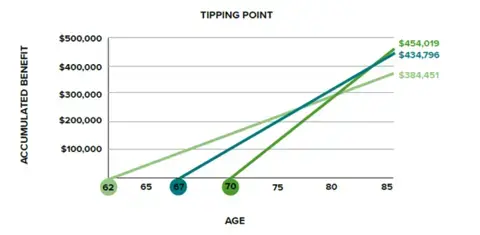

The decision to take Social Security is a balancing act between your immediate financial needs and your long-term security. Although most people become eligible to start claiming benefits at age 62, doing so will reduce the monthly payments you receive and could potentially result in a significant lifetime reduction in total benefits.

On the other hand, delaying benefits until your full retirement age (FRA) or even to age 70 can increase your monthly payments considerably. That’s because waiting allows you to earn delayed retirement credits of up to 8% for each year you delay past your FRA. This approach may lead to higher lifetime benefits, but not in every circumstance. Maximizing your benefits will also depend on your life expectancy, your marital status, your Medicare eligibility, and even your tax rate. We look at these factors below.

Talk to a Wealth Enhancement Advisor about your retirement benefits today.

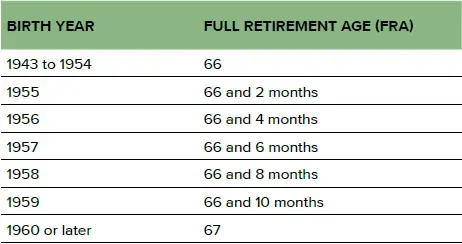

What is Full Retirement Age (FRA)?

Full retirement age (FRA) is the age at which you are eligible to receive your full Social Security benefit without any reduction. This age varies depending on your birth year. If you’re born between 1943 and 1954, your full retirement age is 66. For those born later, the FRA gradually increases until it reaches age 67 for individuals born in 1960 or later.

How to Calculate Social Security Benefits

Your Social Security benefit is calculated based on your average indexed monthly earnings (AIME) during your 35 highest-earning years. The Social Security Administration (SSA) uses a formula to calculate your primary insurance amount (PIA), which is the baseline amount you would receive at full retirement age.

Your benefits are then adjusted based on the age at which you decide to start receiving them. If you claim benefits before your FRA, they will be reduced based on how early you start. On the other hand, delaying benefits past your FRA can result in an increase in your monthly payments.

The SSA provides online calculators to help you estimate your potential benefits based on different start dates. Use these tools to understand how different scenarios may affect your monthly and lifetime benefits.

Social Security: Choosing the Right Time

Beyond the age of eligibility and your FRA, there are a range of additional factors to consider before deciding the optimal time to begin taking your Social Security benefits.

These include:

Your Income and Expenses

When considering when to claim Social Security benefits, begin by reviewing all the assets you have set aside for retirement. For instance, if you are eligible for other government benefits, if you expect to receive a pension, or if you’ve built a sizeable investment portfolio, it may make sense to wait until age 70 before claiming your Social Security. Conversely, if you’re worried about making ends meet, you may not be able to delay your claim.

Your Likely Longevity

Your life expectancy plays a major role in your decision about when to take Social Security. On average, American men have a life expectancy of 74.5 years, while American women can expect to live to age 79.1[1] If you anticipate living a longer life, delaying benefits can provide a larger monthly income, which can help support you throughout a longer retirement. However, if you have health concerns or a shorter life expectancy, starting benefits earlier may provide the income you need sooner.

Our advisors can help you plan your dream retirement.

Your Health Coverage

When you claim Social Security can also affect your health coverage. Medicare eligibility begins at age 65. If you plan to retire before that age, you may want to claim Social Security to help cover your healthcare costs during the gap years. On the flip side, many people choose to retire past age 65 so they can continue receiving health coverage through their employer for as long as possible. By waiting until your employer’s coverage ends, you can enroll in Medicare penalty-free. However, giving up that coverage would require you to apply for Medicare once you reach 65 to avoid paying higher premiums in the future.

Your Marital Status

If you are currently married or were previously married for at least 10 years, you may be eligible for spousal benefits. These benefits can be as much as 50% of your spouse’s Social Security benefit if you claim them at your FRA. In some cases, a lower earner will claim earlier so their spouse can benefit from a delayed claim. In other cases, a sole earner may claim earlier so a non-earning spouse can access Social Security benefits. That said, if a non-earning spouse requires survivor benefits, a sole earner may choose to delay claiming to maximize those benefits.

Taxes on Social Security

Depending on your income level, Social Security benefits may be subject to federal income tax. If your combined income (including your Social Security benefits and other income sources) exceeds certain thresholds, up to 85% of your benefits may be taxable. This is one reason people choose to delay claiming Social Security until after their FRA or even to age 70.

It's crucial to understand your potential tax liability so you can plan your retirement income effectively. Consider strategies to minimize your taxable income, such as using tax-advantaged accounts and managing your withdrawals from retirement accounts.

The Bottom Line

Choosing when to take Social Security is a personal decision that requires careful consideration of various factors, including your financial needs, health, and life expectancy. Your financial advisor can help you evaluate your overall retirement savings and investments, weigh your options, and assess how different start dates could affect your financial future. They can also help you plot out a strategy to invest your Social Security benefits so you can continue to grow your retirement savings and generate additional income over time.

For questions about retirement or help making an informed choice about when to claim your benefits, contact a Wealth Enhancement advisor.

[1] “Why life expectancy in the US is falling,” Harvard Health Publishing, 20 October 2022, https://www.health.harvard.edu/blog/why-life-expectancy-in-the-us-is-falling-202210202835.

Advisory services offered through Wealth Enhancement Advisory Services, LLC, a registered investment advisor and affiliate of Wealth Enhancement Group®. Wealth Enhancement Group is a registered trademark of Wealth Enhancement Group, LLC.

Some content provided by FMG Suite.