You're not alone if you're unfamiliar with the net investment income tax (NIIT). While it's been around since 2010, it's not something that impacts everyone. However, if you have annual investment income and are a high-income earner, you could be subject to this tax—making it important that you understand what it is, how it’s calculated, and how you can plan for it.

What Is the Net Investment Income Tax?

The net investment income tax is an additional tax applied to the investment income of specific individuals, estates and trusts. If your net investment income (NII) or modified adjusted gross income (MAGI) is over a certain threshold, you may owe this 3.8% surtax.

Who Is Subject to the Net Investment Income Tax?

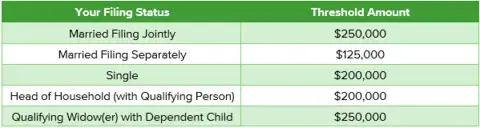

For individuals, the NIIT is 3.8% on the lesser of the net investment income or the excess of MAGI over the threshold amounts found in Figure 1 below:

Figure 1. NIIT Thresholds

Source: Internal Revenue Service

Estates and trusts may also need to pay NIIT. If they have undistributed net investment income and their adjusted gross income (AGI) exceeds the highest tax bracket for an estate or trust for that tax year, then they’ll be subject to NIIT. In 2022, the threshold is $13,450.

While this rule applies to most trusts and estates, the IRS has identified several types of trusts not subject to the NIIT, including:

- Charitable remainder trusts (CRTs)

- Grantor trusts

- Trusts that aren't classified as trusts for federal income tax purposes

- Perpetual care and cemetery trusts

- Alaska Native Settlement Trusts

How to Calculate Net Investment Income

There are many types of investment income, and not all of them are included in the NII calculation. Since you only pay NIIT on net investment income, you need to understand which types of investment income are included and which types are excluded.

Investment income that is included when calculating NIIT:

- Capital gains

- Dividends

- Interest

- Income from passive investment activities

- Non-qualified annuity distributions

- Rental income

- Royalties

Investment income that is excluded from NIIT:

- Wages

- Alimony

- Distributions from some qualified retirement plans

- Operating income from non-passive businesses

- Self-employment income

- Social Security benefits

- Tax-exempt interest

- Unemployment payments

- Capital gains earned from the sale of a primary residence

- Alaska Permanent Fund Dividends

How Is NIIT Calculated?

The first step in calculating NIIT is determining whether you are subject to the tax based on your modified adjusted gross income. If your MAGI is higher than the statutory threshold for your filing status (listed in Figure 1 above), then you are subject to the 3.8% NIIT.

How much NIIT you will owe is based on your net investment income or your MAGI overage, whichever is lower.

To calculate your MAGI overage, Subtract the MAGI threshold for your tax filing status from your MAGI.

Next, you'll need to figure out your net investment income. Calculate all income from sources listed under included types of investment income above. This amount is your gross investment income. Once you know your gross investment income, subtracting eligible deductions will reveal your NII.

Now that you've calculated your MAGI overage and NIIT, you can compare the two.

- If your NII is less than your MAGI overage, then you owe 3.8% tax on your NII

- If your NII is more than your MAGI overage, then you owe 3.8% tax on your MAGI overage amount.

Examples of NIIT Calculation

Here are a few examples of how the 3.8% NIIT may be calculated in the real world, based on your tax filing status:

Single

You have a MAGI of $250,000, and your NII is $30,000. Your MAGI overage is $50,000 ($250,000 – $200,000). Since your NII is less than your MAGI overage, you pay the tax on the $30,000 net investment income. Your NIIT tax obligation is $1,140 ($30,000 x 0.038).

Married Filing Jointly

Your MAGI is $310,000, and your NII is $75,000. Your MAGI overage is $60,000 ($310,000 – $250,000). Since your NII is more than your MAGI overage, you pay the tax on the $60,000 overage. Your NIIT tax obligation is $2,280 ($60,000 x 0.038).

Married Filing Separately

Your MAGI is $200,000, and your NII is $90,000. Your MAGI overage is $75,000 ($200,000 – $125,000). Since your NII is more than your MAGI overage, you pay the tax on the $75,000 overage. Your NIIT tax obligation is $2,850 ($75,000 x 0.038).

Head of Household

Your MAGI is $300,000, and your NII is $20,000. Your MAGI overage is $100,000 ($300,000 – $200,000). Since your NII is less than your MAGI overage, you pay the tax on the $20,000 net investment income. Your NIIT tax obligation is $760 ($20,000 x 0.038).

How Do You Plan for NIIT?

A smart strategy can allow you to mitigate your NIIT obligations while complying fully with tax laws. Some ways to potentially reduce how much you owe:

Timing capital gains recognition wisely

When possible, the recognition of large capital gains to coincide with sales at significant losses decreases your net investment income. If your income fluctuates greatly each year, recognize capital gains in years with reduced income.

Allocating assets strategically

In addition to considering time horizon and risk tolerance when allocating your assets, think about the impact of NIIT. It may make sense to allocate assets with capital gains in tax-deferred or tax-advantaged accounts, such as a Traditional IRA or Roth IRA.

Exploring other investment vehicles

Expand your portfolio to include investments that won't increase your NII. Higher-income, higher net-worth individuals that hold securities with a low-cost basis facing more substantial capital gains may have other options. One option is an Exchange Fund, which allows individuals to "swap" their current position in exchange for a basket of securities. These funds don't allow individuals to avoid capital gains but instead allow for diversification and may offer additional tax benefits.

Another approach may be to invest in real estate, which could bring passive income and deductions for depreciation.

Contributing to a Charitable Remainder Trust (CRT):

A CRT is an irrevocable, tax-exempt trust in which you place assets to provide income for you or your family during a specific period of time. Any money remaining then goes to the charity or charities you choose.

CRTs are exempt from Section 1411 (the section of the tax code that details the NIIT), which means gains sold by the CRT won't be subject to the NIIT. A financial advisor can help you understand how to set up a CRT and whether it’s right for you.

Get Help to Sort Through the Complications

For many high-income individuals, determining modified adjusted gross income and net investment income is a time-consuming, complicated process. It’s critical to consult a financial advisor to understand the impact of transactions before you execute them.

At Wealth Enhancement Group, we integrate financial and tax planning with investment management to assist clients with improving and simplifying their economic life, including helping clients navigate the complexity of NIIT and other hidden taxes. Working with a tax professional can help you better understand how the NIIT will affect your unique situation and how you can best prepare for it.

This information is not intended to substitute for specific individualized tax or legal advice. We suggest that you discuss your situation with a qualified tax or legal advisor.