You spent years–even decades–contributing to your company’s 401(k) retirement plan. Now, it’s time to withdraw those funds so you can use them. Typically, money taken from your employer’s retirement plan is transferred directly into a rollover IRA to avoid being immediately taxed. Sure, when the time comes, it’ll be taxed as ordinary income, but that can be tomorrow’s problem.

However, if your company offered (and you took advantage), you may own a significant amount of company stock as part of your 401(k) plan. If so, then you may have the chance to significantly reduce how much you owe in taxes. How? By utilizing the net unrealized appreciation (NUA) strategy.

What Is Net Unrealized Appreciation?

When dealing with NUA, we’re only talking about shares of company stock you own as part of your employer’s 401(k) plan. While you may have been offered incentive stock options (ISOs), non-qualified stock options (NSOs) or even restricted stock units (RSUs), those don’t count as part of your retirement plan, so they don’t count here.

For income tax purposes, the shares you received in your 401(k) plan have two parts: the cost basis, which is what you paid for the shares (including brokerage fees, etc.); and the appreciation, which is the current value of the shares minus the cost basis (assuming the value of the shares increased after you bought them).

Until you sell your shares, the appreciation is considered “unrealized.” However, with an NUA strategy, when you finally do sell your shares, the appreciation is taxed at much more favorable long-term capital gains rates.

How Is NUA Taxed?

You have a couple options regarding what you can do with your company shares, and each option is taxed differently. You can either roll the shares over into an IRA (which does not take advantage of NUA), or you can transfer all or a portion of the shares into a brokerage account and take advantage of NUA.

Rollover IRA (No NUA)

This works pretty much the same as if you were to simply keep the shares within the company’s 401(k) plan. When you roll the shares into an IRA, all funds and assets in the IRA will eventually be taxed as regular income when you take a distribution–meaning the distribution will be taxed at your regular income rate. Depending on your federal income tax bracket, you could pay as high as 37% in taxes on this distribution.

Brokerage Account (NUA)

In this scenario, when you elect to take a distribution of company stock inside your 401(k) plan, you do so “in-kind” (this means that you’re transferring company stock from your 401(k) plan to a brokerage account). When this happens, you create a taxable event where ordinary income taxes are owed on the cost basis of the stock. Any gain in the stock is immediately eligible for long-term capital gains rates and is not subject to the 3.8% net investment income tax (NIIT). Any subsequent gains are taxed as either short- or long-term capital gains, depending on the holding period from the distribution date of the NUA stock. This post-NUA gain is subject to NIIT if your income is over the threshold.

Long-term capital gains rates are 0%, 15% or 20% depending on your income tax bracket. For example, if you are married and file jointly, and your income is between $80,000-$496,600 you’ll pay the 15% rate. Still, paying just 15% on your stock appreciation is a much more manageable tax bill than paying 30% or more and could result in thousands of dollars’ worth of tax savings.

A Few NUA Examples

Let’s say you purchased company stock for $25 per share inside your employer’s 401(k) plan. At the time you decided to take your distribution, the value of the stock had risen to $60 per share, meaning you had NUA of $35. After the distribution, you decided to hang onto the shares for a period of time, during which, the value of the shares increased again. Finally, when you decided to sell the stock, the value had risen to $80 per share.

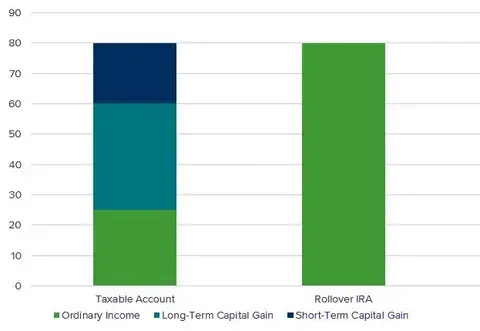

Figure 1 below breaks down the difference in how much of your distribution is taxed with NUA in a taxable brokerage account versus a rollover IRA.

Figure 1: How Your Distribution is Taxed by Account Type

Taking it one step further, let’s offer up an actual, real-world example. Say you owned $200,000 worth of company stock with a total cost basis of $40,000. Further, you file taxes jointly, your combined income is $300,000, and you’re in the 24% income tax bracket.

For this example, you decided to transfer the shares into a brokerage account versus rolling them over into an IRA. When you used NUA on February 13, 2018, you paid regular income tax rates (24%) on the $40,000 cost basis, but you would only pay long-term capital gains rates (15%) on the $160,000 appreciation once you sell the stock. The appreciation is also not subject to NIIT, which is another 3.8%.

Additionally, let’s say you decided to hang onto those shares for another six months after using the NUA rule and the value jumped to $210,000. When you sold your shares on July 13, 2018, that extra $10,000 was taxed at the short-term capital gains rate (which is the same as your regular income rate, or 24%), and it was also subject to NIIT (3.8%). However, if you held those shares for more than a year and instead sold them on March 8, 2019, after the value jumped again to $230,000, the extra appreciation is once again taxed at long-term capital gains rates, though it was still subject to NIIT.

Figure 2 takes the example above and compares the taxes due and total after-tax distributions of a brokerage account with an NUA versus an IRA rollover.

Figure 2: Brokerage Account with NUA vs. Rollover IRA

|

Brokerage Account (w/ NUA) |

IRA Rollover |

Cost basis of shares |

$40,000 |

$40,000 |

Original value of shares on 2/13/18 |

$200,000 |

$200,000 |

Appreciation of shares |

$160,000 |

$160,000 |

Tax rate for cost basis |

24% |

24% |

Tax rate for appreciation |

15% |

24% |

Taxes due if shares are sold on 2/13/18 |

$33,600 |

$48,000 |

Total after-tax distribution on 2/13/18 |

$166,400 |

$152,000 |

|

||

Value of shares on 6/13/18 |

$210,000 |

$210,000 |

Additional appreciation of shares since 2/13/18 |

$10,000 |

$10,000 |

Tax rate for additional appreciation |

27.8%* |

24% |

Taxes due if shares are sold on 6/13/18 |

$36,380 |

$50,400 |

Total after-tax distribution on 6/13/18 |

$173,620 |

$159,600 |

Value of shares on 3/8/19 |

$230,000 |

$230,000 |

Additional appreciation of shares since 2/13/18 |

$30,000 |

$30,000 |

Tax rate for additional appreciation* |

18.8%* |

24% |

Taxes due if shares are sold on 3/8/19 |

$39,240 |

$55,200 |

Total after-tax distribution on 3/8/19 |

$190,760 |

$174,800 |

*Includes 3.8% NIIT based on combined income of more than $250,000

What Are Advantages of NUA?

It’s important to remember that NUA won’t always be the right course of action for you when you decide to take your 401(k) distributions. However, when it does make sense, the advantages are clear.

As seen in the table above, NUA allows for the appreciation on your shares to be taxed at the lower long-term capital gains rates. Additionally, any further appreciation after taking the distribution also has the potential to be taxed at the same long-term capital gains rates. This means you can significantly reduce your tax liability when you sell your shares, thus ensuring you end up with a larger after-tax distribution–leaving more money in your pocket and less in Uncle Sam’s.

Eight Things to Consider Before Utilizing NUA Strategy

NUA does come with some rules attached, so there are a few other things you’ll want to keep in mind before pursuing this strategy.

1. Make Sure Qualifying Events Are Top of Mind

First and foremost, an NUA can only occur after a qualifying event. While an NUA transaction does not have to be completed on the same date as the qualifying event, it can only occur after the qualifying/triggering event. A qualifying event is when an employee:

- Dies

- Reaches age 59 ½

- Separates from service

- Becomes disabled

It is possible that a person may have the ability to do an NUA on more than one occasion because he or she can become eligible after each qualifying event. For example, someone may reach age 59 ½ and their employer plan allows in-service distributions. At that time, they could do an NUA. Then, when they retire, they would be eligible to do an NUA again on any additional stock purchased.

2. Remember to Take a Lump-Sum Distribution

Additionally, the entire 401(k) needs to be distributed from the account by December 31 of the year in which the NUA transaction happens. This is called a “lump-sum” distribution, and while it’s required that the entire account is distributed, it’s also possible to get a little crafty here. You can take some of the shares, those with the lowest cost basis, and use the NUA strategy while rolling over the remainder to an IRA. This allows you to receive the favorable tax treatment on at least part of your distribution while letting the rest sit in an IRA. Further, if someone had taken money out of his/her 401(k) in a previous year, he/she is then disqualified from completing an NUA until the next triggering event.

3. Understand the Potential Impact on Your Income Taxes

It’s important to remember that brokerage accounts are taxable accounts–meaning any realized gains are taxed at year-end and any dividends and interest paid in a year are also taxable. Moving shares into a taxable brokerage account will have income tax implications and may have estate planning considerations as well. It’s important to speak with your tax advisor about your individual situation to see if an NUA makes sense for you.

4. Consider Your Overall Portfolio Diversification

If a large portion of your retirement assets (conventional wisdom says no more than 10%) are concentrated in employer stock, it might be smart to only transfer a portion of the shares into a non-qualified account. The remaining shares could then be rolled into an IRA and diversified tax-free.

5. Consider Your Current and Future Tax Bracket

While you may be able to do an NUA before you retire, most people wait until after retirement. While you may be eligible at age 59 ½, you’re likely also in your peak earning years, which can also be your highest tax rate. If you do an NUA while still working and earning, you’ll pay taxes on the cost basis at a higher rate. Most people are in a lower tax bracket once they retire–so if you wait until you’re retired, you’ll get more value out of the NUA transaction based on a lower income tax rate.

For these reasons, you’ll need to think about when you plan on retiring and your lifestyle expectations once you do retire. These can factor into if/when you take advantage of NUA.

It might also be a good idea to factor in whether you have the ability to pay the tax on the NUA. If your money is in qualified accounts and you don’t have an adequate reserve, you may have to either sell some shares or withdraw from an IRA to pay the tax, which could in turn move you into a higher tax bracket.

6. Think About Gifting Opportunities

Individuals can gift up to $15,000 per year per person to any number of people before they incur gift taxes. A gift of highly appreciated stocks within these limits has no immediate tax consequences to either the donor or recipient. In this case, the gift transfers the donor’s cost basis from the shares to the recipient and removes both the current value and any future growth from the donor’s estate. However, it also subjects the recipient to the capital gains on the stock when sold. This works well when the beneficiary is in a lower tax bracket (e.g. 15% instead of 18.8%, or 0% instead of 15%).

7. Consider Charitable Giving

Highly appreciated employer stock may be a useful asset to contribute to a charitable trust. When you gift appreciated stock, you get to deduct the fair market value–not just the cost basis from taxes. The deduction is restricted to 30% of your adjusted gross income (AGI), but it can be carried forward five years. Also, you can avoid realizing capital gains on the donated shares.

8. Use a Selective NUA Strategy

NUA rules allow for the flexibility to transfer specific shares to a taxable brokerage account while the rest roll over into an IRA. This is advantageous if your shares were acquired at different times and at differing cost bases. You can then transfer only the shares with the lowest cost basis, since those should be the ones with the most appreciation.

This strategy requires extra analysis of your shares (and likely input from your financial advisor) but can yield the greatest results. It also requires appropriate record keeping from the 401(k) administrator. A lot of administrators just keep track of the average basis of the entire stock holding and do not let the participant pick and choose shares.

NUA Strategy Next Steps

Again, whether or not you decide to take advantage of NUA is up to you relative to your specific situation. As we covered, there are restrictions to taking NUA, and while the tax advantages are clear, your situation might mean it’s better to push that taxable event down the road than to immediately pay income taxes on a distribution.

Since NUAs are so complex and come with so many caveats, it’s important that you consult your financial advisor before pursuing that course of action. They know your situation and are in the best position to tell you whether or not an NUA strategy is a viable option.

And if you’re looking to learn more about stock options and other forms of non-cash compensation, download our complimentary eBook, The High Income Earner's Guide: Navigating Non-Cash Compensation.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.