Retirement planning can feel like navigating a sailboat through the Bermuda Triangle. From shifting inflation rates to unknowable health care costs, it can seem impossible to know exactly what route to take and how much to save. That’s why we created a Retirement Income Calculator to help you estimate what you may need to save to support your lifestyle into retirement.

Are you financially prepared for retirement?

According to the 23rd Annual Transamerica Retirement Survey of Workers, a third of American workers are not confident that they will be able to fully retire with a comfortable lifestyle.

Generation X is the least confident generation by far. A staggering 40% of Gen X survey respondents stated that they are not confident they will be able to retire comfortably. Meanwhile, a full 30% of Millennials and Baby Boomers responded that they are not confident. Gen Z came in as the most confident, with only 26% of Gen Z survey respondents stating they are not confident.

If you happen to be among the large group of people who aren't confident in their ability to retire comfortably, there are steps you can take to course-correct.

By following along through these next sections and considering the questions as they apply to your unique situation, you'll set yourself up to use our retirement income calculator to your best advantage.

Check your retirement readiness with our Retirement Income Calculator

5 Steps to Get Financially Ready for Retirement

Retirement readiness isn't just about reaching a certain age. It's about ensuring you have the financial security to enjoy the next phase of your life—whatever that phase might look like. But how can you know that you're on the right track? It starts with understanding your current financial status and projecting what your future needs might be.

1. Assess your current financial status

First of all, you need to figure out how much you have.

Is your nest egg spread across multiple different accounts, like 401(k)s or IRAs? If so, do you understand the different tax implications of those accounts, and how your future tax burden could change the underlying variables of your retirement income strategy?

Alternatively, is much of your net worth tied up in your business? If so, do you have an exit plan in place to turn that illiquid wealth into tangible retirement income?

While you're looking at your investments and savings, it's also a good time to consider what your current lifestyle looks like, and how that lifestyle might change after you enter retirement. Are you planning to stay in the same house? Do you have extensive (expensive) travel plans? Are there items on your bucket list that you can't wait to complete?

It might seem a bit early to do so, but now is the perfect time to start generating a ballpark number to target for your desired retirement income.

2. Estimate your future needs

Whether you like it or not, retirement will bring a shift in your expenses. Some costs might go down, like your gasoline bill if you're a daily commuter. However, other costs might go up, like health care.

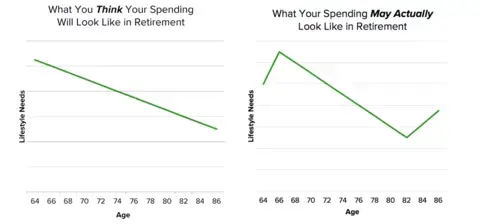

At Wealth Enhancement Group, we often find that our clients' overall expenses actually increase when they enter retirement. You're still young and full of energy, so you start scratching items off of your bucket list and don't slow down for a while. As retirement goes on, you may see those expenses slowly and steadily decrease. However, later in retirement, you might find that your spending actually increases again, as you start needing to shell out more for health care expenses.

Don't let this graph scare you. If you're here and thinking about your retirement income plan early, then you're on the right track to having enough money to adequately fund your retirement.

3. Determine when you want to retire

Retirement doesn't just automatically happen when you turn 65. It’s been said before: retirement isn't an age—it's a state of financial readiness. The earlier you start saving and planning for retirement, the more time your money has to grow through compound interest.

As you review your current investments and consider how much more you need to save, think about the power of compound interest. Compound interest happens when you earn interest on the money that you've already invested, then reinvest that money to keep earning more interest on it. In other words, the longer you keep your money invested, and the more money you save, the more compound interest can work for you.

Our retirement income calculator assumes that your investments will earn a certain percentage of compound interest over time, so you fortunately don’t have to do the math yourself. But do keep in mind that investing earlier may mean that you can potentially choose an earlier target retirement age.

Another consideration when it comes to your expected retirement age is your Social Security claiming strategy. Many people don't know this, but you can actually apply to start receiving your Social Security benefits as early as age 62. The catch is that you'll receive a 25% lower benefit for the remainder of your retirement.

The Social Security Administration considers Full Retirement Age (FRA) to be age 66. Claiming your Social Security benefit at this age will net you 100% of the total benefit. If you want, you can also wait as late as age 70 to start claiming your benefit. If you do, you'll end up with payments 32% greater than the FRA benefit.

Your Social Security strategy is a risk-benefit analysis that's best done with the experienced guidance of a qualified financial advisor.

4. Factor in inflation

In 2022 and 2023, we all experienced the searing pain of inflation on our savings, earnings, and expenses. Inflation can erode the purchasing power of what you've already saved up. Although it's difficult to explicitly plan for inflation, diversifying your investment portfolio and regularly reviewing your portfolio allocations can help cope with the threat of future inflation.

5. Use a retirement calculator to see if you’re on track

To use the Wealth Enhancement Group Retirement Income Calculator, you first need to navigate to the calculator's page, here. From there, you'll enter your own personal details, such as your current age, target retirement age, current savings, expected lifestyle costs, and more. The more accurate the information you enter, the more helpful your retirement income projections will be. Remember that Wealth Enhancement Group keeps all of your information confidential.

After you enter your information, the calculator will project your savings growth and estimate the income you need. Our calculator leverages powerful forecasting algorithms to help you understand how much more you need to save to enable the retirement of your dreams.

Once you've fully understood your calculator's initial output, play around with the inputs and explore different scenarios. For instance, you can see how your retirement income will change if you adjust your target retirement age or your savings rate. This can help you understand the impact of the different decisions you make as you continue on your retirement planning journey.

Planning for retirement doesn't have to be daunting, but it is a critical aspect of financial wellness. With the Wealth Enhancement Group Retirement Income Calculator, you can illuminate the path towards a comfortable and secure retirement.

Remember, while this calculator is a powerful planning tool, it’s just the beginning. Everyone's financial situation is unique, and navigating the complexities of something as complicated as retirement planning can be incredibly challenging. If you have questions about your calculator results, need more information, or want more guidance on your journey to retirement, reach out to a Wealth Enhancement Group financial advisor today and schedule a complimentary, no-obligation meeting.