Retirement is, undeniably, a major transition. Over the coming months, you’ll make the shift from going to work on a daily basis to spending your time with either a part-time job or something outside the workforce altogether.

This reduction in hours worked isn’t the only big transition you’ll face. You’ll also be making the switch from saving for retirement to withdrawing funds from your accounts and spending in retirement, which can come with a lot of concerns, including how to make sure your savings last throughout retirement. Following these tips can potentially help relieve some of that worry and provide a successful transition into retirement.

Schedule Your Newfound Free Time in Retirement

It sounds counterintuitive. After all, isn’t the whole point of retiring to NOT have to follow a schedule? Trust us; you’ll be happier if you do. We often hear that one of the hardest parts of the transition is figuring out what to do with all your extra time.

At least plan the first few months of your retirement. Get into routines of watching the grandkids, traveling, or pursuing your favorite hobby. Try a new class or activity. This is your chance to do the things a full-time job did not permit you to do.

Start Living on Your Retirement Budget

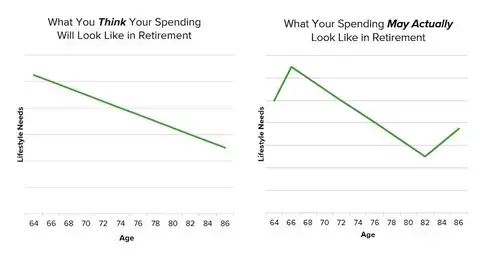

Did you know that most people actually spend more in the first few years of retirement? A lot of people simply assume they will be spending less. After all, you won’t have to travel to and from work every day, right? But with all that new free time on your hands, you may end up with a spike in spending in the years after you retire. Many people start traveling or crossing items off their bucket list that they weren’t able to do while working. This is usually followed by a spending uptick in later years with health care and long-term care costs kicking in.

Figure 1: Expected Retirement Spending vs. Actual Retirement Spending

If you haven’t made a detailed retirement budget, do that now. Then, spend the next few months living on it. If it’s not enough, talk to your financial advisor about making some adjustments to generate revenue. If it’s more than you need, consider withdrawing less from your investments to stay in a lower tax bracket. Minimizing your Adjusted Gross Income (AGI) may also reduce your Medicare premiums down the road.

Plan for the Financial Long Haul

You might be retired for longer than you think: 40.6% of all households where the head of the household is between 35 and 64 are expected to run out of money in retirement. Take an inventory of all your accounts and decide if your investments are organized in a way that can sustain you for the years and decades down the road—including developing a strategy to cover rising health care costs.

With evolving tax laws, it might make sense to complete a Roth conversion on some of your Traditional IRA income. This will help you pay less in taxes and help you avoid large required minimum distributions (RMDs) when you hit age 72.

Analyze Social Security Benefits Before Filing

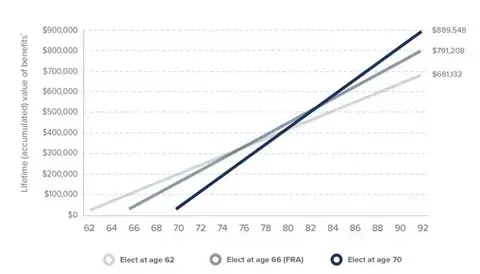

It’s common to underestimate how much money you’ll receive from Social Security during your lifetime. The reality is, a married couple receiving the maximum monthly benefit could collect a lifetime total that approaches $1.75 million. Of course, that lifetime benefit amount varies based on a lot of individual factors, including your work history, when you choose to file, and your life expectancy.

The graph below demonstrates how claiming benefits before your full retirement age or delaying claiming until age 70 can have an impact on the total lifetime value of your benefits as you approach age 92.

Figure 2: Estimated Lifetime Social Security Benefits

Source: Social Security Administration, www.ssa.gov. *Estimates are shown in today’s dollars and based on assumptions for someone born 1/1/1949 earning the Social Security wage base maximum since 1976 or earlier. No cost of living adjustment, inflation estimates or reinvestment rate are included.

The moral here is that the decision of when to claim your Social Security benefit may be more important (and complicated) than you think it is. Since it’s difficult to reverse your claiming decision once you make it, it’s important to analyze your Social Security strategy before you file.

Take Advantage of a Lower Taxable Income

Once you stop working full time, there’s a good chance your taxable income will decrease, thereby potentially pushing you into a lower tax bracket. These years of lower income can allow you to unlock powerful tax planning strategies, namely the opportunity for tax-free long-term capital gains.

For example, for those in the 10% and 12% tax brackets (taxable income up to $41,775 for singles and $83,550 for married filing jointly for taxes due in April 2023), long-term capital gains have a 0% federal tax rate, although you’ll likely face state taxes on those gains. That means, if you’re filing jointly with $50,000 in taxable income, you could incur an additional $30,000 in long-term capital gains without any federal tax implications—a savings of $4,500 in future federal taxes, assuming a 15% capital gains tax rate.

Consider the Costs of an Early Retirement

If you’re working toward an early retirement, there are two key financial implications you need to plan for. First, Medicare eligibility doesn’t begin until age 65. This means you may have to pay out-of-pocket for private insurance premiums for a few years, which could end up being more costly than you realize. Second, the earlier you retire, the longer your retirement nest egg has to last, which may force you to either invest more aggressively during retirement or take smaller annual withdrawals to help preserve your savings.

Talk to Your Advisor

Major life changes can be both exciting and nerve-wracking moments. The key to dealing with these emotions is preparation, which is why comprehensive retirement income planning before you retire is key to being ready for the transition into retirement. Talk to a financial planner who can walk you through your options to help your savings last throughout retirement while keeping more of your wealth and paying less in taxes.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.