As investors near and enter retirement, their risk tolerance tends to become more conservative. It’s easy to stay aggressive in the markets when you have an income covering your lifestyle. But once you no longer have that steady income stream to pay for your expenses, it’s time to start spending your savings and investments. This can be a scary thought, leading to the question, "Have I saved enough, or am I going to run out of money?”

For many people, this shift from a strategy of saving to a strategy of spending can have many unforeseen consequences. What happens when it’s time to start cashing out those investments you’ve been sitting on for years?

Often, large, embedded capital gains result from a long-term buy-and-hold strategy. Selling assets that have had significant time to grow can sometimes create a snowball effect of tax problems.

However, with some planning, you can take control of your tax situation and lessen the effect of high capital gains and other overlooked tax liabilities.

A “Typical” Retiree Situation

To illustrate this point, let’s meet Jake and June Jones.

- Jake is 64 and happily retired

- June is 63 and plans to retire in 2025

- Jake receives a pension, and they both plan to wait until they reach full retirement age (in this case, 67) to take their Social Security benefits.

- In their brokerage account, they have accumulated a highly concentrated stock position of ABC with substantial unrealized capital gains of $350,000

Given this scenario, the Joneses’ biggest concern is their potential tax hit and being too heavily weighted in one company’s stock. The solution: Diversify their portfolio and optimize their tax situation.

Tax optimization is a broad topic, considering there are many types of taxes one may be subject to. However, for the Joneses, the main culprit is their capital gains tax liability, which can potentially create other problems like the net investment income tax (NIIT) and higher Medicare premium thresholds.

Want to minimize your tax burden? Click here for a free consultation to discuss the most tax-efficient strategies.

Capital Gains Tax

An investor is subject to capital gains tax when selling a position, also called realizing a gain or loss. A capital gain tax bill is generated when you sell a position for more than you paid for it, and the difference between what you paid for the position and what you sold it for is subject to capital gains tax.

If you hold onto a position for more than one year before selling it, it qualifies as a long-term capital gain. However, if you sell a position within a year, any gain would be considered a short-term capital gain.

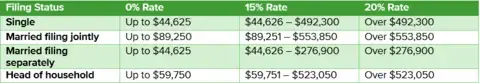

How capital gains are taxed depends on if they are long-term or short-term. Short-term capital gains are taxed at regular income rates. Still, as you can see in Figure 1 below, long-term capital gains are taxed at much more favorable rates, meaning it's more beneficial for you to—if it makes sense—hang onto your positions for over a year.

Figure 1. Long-Term Capital Gains Tax Rates, 2023

Source: Internal Revenue Service

Medicare Premiums

Medicare kicks in at age 65, and the monthly premium is based on the previous two years’ adjusted gross income (AGI). There are some caveats, but we'll assume the Joneses’ premium is based on the traditional two-year AGI look-back for today's purpose.

This means that selling their stock in ABC and realizing such a large capital gain could increase their AGI enough to raise their Medicare premiums.

Net Investment Income Tax

Net Investment Income Tax (NIIT) is an additional 3.8% tax that is lesser known and is often overlooked because it needs to be clarified. Simply put, taxpayers are subject to NIIT on the LESSER of their net investment income (for example, their capital gains and dividends) or the amount above the $250,000 modified adjusted gross income (MAGI).

Like the potential increase in Medicare premiums, NIIT could come into play if the Joneses’ capital gains tax hit is enough to increase their MAGI past the NIIT threshold. In this event, they would be required to pay an additional 3.8% when they file their income tax returns.

What the Joneses Should Do

The goal when repositioning a portfolio is to reduce risk and align the investments with current and future goals. Part of this strategy is asset diversification. Since the Joneses have such a high concentration of stock in ABC, adequate asset diversification will reduce their market risk and result in a sizeable tax bill.

To bring these concepts together and develop a transition strategy for the Joneses, we’d start with a plan that considers their financial situation, their portfolio’s risk exposure, tax situation, future taxable events, income needs, etc. We’d run different “if this, then that” scenarios to help them understand potential outcomes and feel more confident with their decisions.

We recommend a strategy for the Joneses that optimizes their tax situation. This means selling 1/3 of their ABC stock position over a span of three years (Note: this scenario assumes they were comfortable with a longer transition period).

By enacting this strategy, the Joneses would realize $117,000 worth of capital gains each year for three years, keeping their AGI below $194,000. The resulting tax impact means:

- Their capital gains are taxed at a more favorable rate of 15%

- Their Medicare premiums for Part B are $164.90/month and $0 for Part D (the lowest premium bracket)

- They would NOT be subject to NIIT, as their MAGI is below the $250,000

This strategy will reduce the portfolio's risk tax-efficiently and remove their dependency on ABC Company stock. In turn, they'll free up cash to diversify into an investment strategy more suitable for their situation.

As planners, we see similar situations quite regularly. Of course, additional ways to maximize these concepts require some advanced planning. But long story short, you have more control over your taxes and investments than you might realize—it just takes some upfront planning. And if you want to learn more about incorporating efficient tax planning into your financial plan, schedule a free meeting today.

This information is not intended to provide tax or legal advice. Discuss your specific situation with a qualified tax or legal advisor. There is no guarantee that asset allocation or diversification will enhance overall returns, outperform a non-diversified portfolio, nor ensure a profit or protect against a loss.