For the period April 1 – April 30, 2025.

Executive Summary

Equity markets experienced significant volatility in April but ultimately ended on a positive note. Amidst ongoing concerns about the trade war, uncertainty persists, shaking investor confidence. Even as the stock market recovers, making bold predictions as to what happens next is a futile task.

What Piqued Our Interest

If one were fortunate enough to have been cut off from all forms of communication in April and simply looked at the final investment market performance numbers, you might have thought April was just another slightly down month for the market. However, the reality, as we know, was quite different. The selloff that began last quarter persisted into April, leading to a more-than-20% decline in the S&P 500 from its all-time high on February 19. The Nasdaq 100, heavily weighted with Growth and Tech stocks, fell even further, dropping 23%.

This downturn escalated following President Trump’s announcement of reciprocal tariffs on April 2, dubbed “Liberation Day.” The significant policy change, which impacted nearly every aspect of global trade, set off a chain reaction, accelerating imports to beat the tariffs, igniting a market selloff, and significantly impacting investor and business confidence. By mid-April, many tariffs were delayed, which helped spark a substantial rally. Along the way, the CBOE VIX Index, which measures market volatility, soared to 65—its highest level since the peak of the pandemic in 2020.

The first reading of Q1 GDP, though admittedly backward-looking, showed the lowest quarter of economic growth since Q1 2022. The preliminary results for Q1 2025 came in at -0.3% Q/Q, below the consensus expectation of a +0.3% increase. The report attributed the decrease primarily to an increase in imports and a reduction in government spending. One shouldn’t be overly concerned by the reading, but it does help demonstrate the short-term impact of tariffs on the economy.

Despite the heightened uncertainty, much of the “hard” macroeconomic data remains supportive of a healthy economy. March Core PCE inflation (the Fed’s preferred measure of inflation) was unchanged month-over-month, matching consensus expectations for a 0.1% rise and February's unrevised 0.4% increase. On an annualized basis, Core PCE stood at 2.6%, in line with consensus. March personal spending rose 0.7% M/M, exceeding expectations for a 0.5% rise. In addition, pending home sales surged 6.1% in March, far surpassing the consensus forecast of a 1.0% increase and the prior month's 2.1% rise.

Conversely, the “soft” economic data, including surveys and sentiment, paints a different picture. Consumer sentiment declined for the fourth consecutive month in April. The University of Michigan Consumer Sentiment Index plummeted to 52.2 in April, one of the lowest levels on record. This represents an 8.4% drop from March and a 32.4% decline compared to a year ago, marking the largest annual decline since July 2022. Elsewhere, according to the Institute for Supply Management’s PMI Survey, economic activity in the manufacturing sector contracted in April for the second consecutive month.

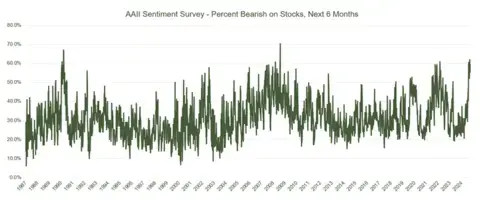

Source: American Association of Individual Investors

Investor sentiment, as measured by the American Association of Individual Investors (AAII) Index, has been extremely bearish. As of April 30, the percentage of bearish investors stood at 59.3%, a historically high figure relative to the long-term average of 31%. There have been only seven periods where AAII bearish sentiment lasted more than four weeks, as it has today. Four out of the previous six times, the market was higher one year later, with an average return of 11.8%, including negative years in 2008. While past results are not indicative of future performance, when we look back in time, investing in stocks during past peaks of bearishness has worked well for long-term investors.

Market Recap

U.S. equity markets plunged into bear market territory in April (defined as falling 20% from a recent peak) but rebounded sharply as some trade tensions eased. The blue-chip Dow Jones Industrial Average, which had been holding up better than the S&P 500 in Q1, slipped the most, falling by -3.08%. Small Caps, as measured by the Russell 2000 Index, continued to underperform and are now down -11.57% for the year. From a sector perspective, Energy stocks plummeted -13.65% in April, as WTI crude oil dropped from around $71 to $58 per barrel due to concerns related to decreasing demand coinciding with increased OPEC supply. On the flip side, the S&P 500 Index’s Information Technology sector was the top-performing sector at +1.62%, supported by a big rally from the Magnificent 7. However, the sector remains lower YTD, down over 11%.

In its early stages, the trade war has prompted a “sell America trade” as international markets continue to outperform U.S. stocks. The developed international MSCI EAFE Index rose 4.58% in April and is now up 11.76% YTD. The Emerging Markets Index increased 1.31% in April and 4.28% YTD. Meanwhile, the broad U.S. bond market index held up well, gaining 0.39% for a 3.18% return YTD. This occurred after a mid-month bond yield backup, which may have influenced the Administration’s decision to delay some tariffs.

Wealth Enhancement Perspective

Attempting to make bold predictions at this stage is futile, as the trade rhetoric from the White House appears to be changing daily. There are numerous wild cards when assessing the current backdrop: How long will tariffs remain in place? Will tariff levels increase or decrease? Which countries will choose to negotiate or wait it out?

Fortunately, it appears we entered this trade war on relatively solid footing, suggesting that if we experience a recession, it could be milder. While the outcome of the trade war remains uncertain, investors with long-term time horizons can capitalize on market dislocations like this. Look for opportunities to harvest losses, put idle cash to work at more attractive equity valuations, embrace international diversification, and rebalance portfolios to align with your personal financial goals.

This information is not intended as a recommendation. The opinions are subject to change at any time and no forecasts can be guaranteed. Investment decisions should always be made based on an investor's specific circumstances.

2025-7699