A lot is happening in the financial world these days. Inflation rages on, investment markets drop into bear territory, and talk of a looming recession is heating up.

One headline you’ve likely seen but may not have paid much attention to is the rise in interest rates. After raising interest rates by 0.75% in June, the Federal Reserve is now on pace to lift rates an additional 1.75% by year-end to a range of 3.25–3.50%. Implications of these hikes are widespread, impacting lending costs, mortgage rates, and capital markets.

The reason for these rate increases is clear: get inflation under control. However, how these rate hikes can affect your financial situation may not be as clear.

How Interest Rate Hikes Affect Your Savings

A rise in interest rates is actually good news for your savings. As the Fed continues to raise its target federal funds rate (the benchmark interest rate banks charge each other for overnight lending to maintain a Fed-mandated minimum balance in their accounts), different interest rates are also increasing. This includes the interest you earn on savings accounts, certificates of deposit (CDs) and money market accounts.

Since the increase to the target federal funds rate means banks can charge each other more, they have more wiggle room to offer customers higher annual percentage yields (APYs). The increase won’t be anything astronomical (potentially as high as 2% by the end of the year), but competitive savings rates generally follow the federal funds rate. So, watch for rates to rise as the Fed increases its benchmark interest rate.

How Rate Increases Affect Borrowers

Rising interest rates are bad news if you're looking for a loan or are carrying credit card debt. The banks' ability to charge each other more means they can charge you more to finance a car, pay interest on your credit card, or apply for a mortgage.

Depending on the size and length of your loan, a higher interest rate might not seem like a big deal, but even a 1% boost in your interest rate can increase the cost of a $300,000 mortgage by more than $2,000 a year. Over time, that can add up.

However, rising interest rates can deter prospective home buyers from taking the plunge. A competitive housing market and higher rates may price many buyers out of the market. In this instance, higher rates could cool down the market, lowering home prices enough that you may be able to afford that new house, even in a higher rate environment—you’re still paying more in interest, but you don’t have to borrow as much.

How Interest Rate Increases Affect Your Investments

Higher rates can have very different effects on your investments, depending on your investment vehicle of choice. For our purposes, we’ll focus on stocks and bonds, as they’re arguably the two most prominent types of investments.

Higher Rates and Stocks

Generally, rising interest rates are a good sign for stocks. If the economy is growing, and the Fed raises rates to slow down that growth, your stocks will likely perform well.

Unfortunately, our current bear market environment means stock values are falling. However, the markets typically prepare for such events as interest rate hikes, so that’s usually already baked into stock values. While higher interest rates can affect many things, they don't have much impact on your stocks.

Higher Rates and Bonds

The bond market is likely where you're going to see the impact of higher interest rates. Generally, bond prices rise and fall alongside prevailing interest rates. The relationship between bond prices and interest rates is inverse: As interest rates go up, bond prices go down, and as interest rates go down, bond prices go up.

If you’re already invested in bonds and rates go up, it won’t have any effect on your investments. Bonds are a fixed-income security, meaning they pay out a fixed rate of return over a set period. So, when you buy a bond and hold it to maturity, the only way you can lose money is if the bond's issuer goes into default or bankruptcy.

However, you can take advantage of some bond investment strategies when rates go up.

Building a Bond Ladder

If you're looking to invest in bonds and have been waiting for interest rates to rise, you may consider building a "bond ladder." A bond ladder is a portfolio of bonds that mature on different dates. Building a bond portfolio with different maturities can generate income while minimizing your exposure to interest rate fluctuations.

It works like this: You invest in bonds with different maturities and different yields. When the shorter-term bonds mature, you can reinvest the principal in new bonds with longer-term maturities. If rates rise, you can take advantage of the higher yields. But if rates go down, you’re still invested in other bonds with higher fixed rates of return.

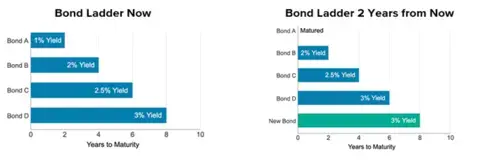

Figure 1. Bond Ladder Example

Source: Charles Schwab

For example, Figure 1 above shows an investor with four bonds at four different yields and four different maturities. The combined average annual yield is 2.125%. After two years, the shortest-term bond matures, and the investor reinvests those funds at the longest-term maturity (eight years). Even though the interest rates haven’t changed in the two years since the bond ladder was created, the combined average annual yield still jumps to 2.625%.

Let's say rates increase over those two years. If the investor reinvests the matured bond into a new bond with a 3.5% yield, the combined average annual yield jumps up even higher to 2.75%.

How Interest Rate Increases Affect My Financial Plan

Changes in the economy can potentially have far-reaching effects on your overall financial plan—or they can have minimal impact. Every situation is different, so what may be good for your neighbor may not be good for you.

That said, periods of sustained higher interest rates can be a great time to reevaluate your portfolio and your allocation of bonds versus stocks. Having the additional exposure to bonds as yields go higher can provide a better balance of risk in your portfolio.

Reach out to a financial advisor today to find out what other moves you may want to consider as interest rates rise.