Retirement planning is crucial for everyone, but it introduces particular challenges for women. With longer life expectancies, as well as reduced earning potential due to the gender pay gap and other factors, women face a unique set of obstacles in preparing for retirement compared to men.

There is ample data backing up these gender-based disparities. That's the math. The myth, however, is that you can do nothing about it.

In truth, numerous strategies exist to overcome these hurdles. All it takes is some savvy planning.

Retirement Challenges Women Face

In planning for retirement, it’s important to acknowledge the challenges women typically encounter. These include:

Longer Life Expectancy

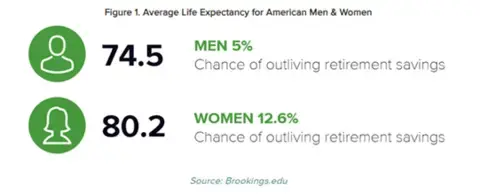

On average, American women live almost six years longer than men. And with the same starting asset values, portfolio investments, and withdrawal rates, those six extra years make it more likely that the average woman will outlive her retirement savings compared to the average man.

Longer lives also translate into higher lifetime healthcare costs. According to the Retiree Health Cost Index, an average 65-year-old woman can expect to spend $155,000 on healthcare over the course of her remaining lifetime compared to $134,000 for an average 65-year-old man.

Get started on your retirement plan today by scheduling a complimentary introductory meeting with a Wealth Enhancement Group advisor.

Higher Expenses

What’s more, women often pay more than men for similar items. Research shows that consumer products targeted and advertised to women are sometimes more expensive than comparable products marketed to men. This disparity is referred to as the “pink tax.” And this inequality starts early. For example, one retailer recently listed a blue children’s scooter for $24.99 and an identical pink version for $49.99.

Financial Disparities

Similarly, on average, women receive 20% less in Social Security benefits than men. Childbirth and years of caregiving tend to make a woman’s career shorter than a man’s. More women retire early. Women generally receive lower pension benefits due to their relatively lower earnings, and a higher share of part-time workers are women.

Combined, these factors make many women less likely to have access to an employer-sponsored retirement plan. Even among women who do participate in these plans, lower earnings result in lower matching contributions, putting women at a savings disadvantage.

Gender Pay Gap

That’s all without even touching the gender pay gap. On average, women working full-time and year-round are paid 83.7% of what men are paid. This gap has barely budged in the past 20 years, slightly increasing from 80% in 2002.

Lack of Financial Confidence

At the same time, many women admit that they lack the confidence to make long-term financial planning decisions. This, in turn, affects their investment choices and may hamper their retirement outcomes. Despite this lack of confidence, women tend to see better returns than men. A recent study found that women outperform men by 0.40% and take fewer risks with their investments (more on risk later!).

6 Savvy Retirement Planning Strategies for Women

Despite these very real challenges, there are steps you can take to set yourself up for the retirement you’ve always dreamed of.

1. Understand Your Retirement Budget

One of the best ways to save for retirement is by laying a solid foundation. This means identifying your financial goals, factoring in your family situation, and then determining how much money you can set aside on a regular basis considering your current income and expenses. Once you know how much you can save as either a fixed dollar amount or a percentage of your earnings, consider setting up an automatic payment plan that routes your funds to your retirement savings account every week or month. Even small amounts contributed consistently over time can make a big difference in the long run.

2. Allocate Your Assets Strategically

Women tend to be "stewards of safety." This means that, in general, women take fewer risks than men, and this idea often carries over into investments. However, by steering clear of the "riskier" investments, you may also be closing yourself off to the potential for greater rewards.

To address risk without hampering your long-term earning potential, strategic asset allocation is key. Are you investing in a variety of asset classes that offer differential performance in different market conditions? Are your holdings spread across various industries, geographic locations, and risk profiles? Have you implemented appropriate hedging strategies to buffer downside risk?

Where you choose to invest—and how much—can have a powerful impact on your future finances. By crafting a properly diversified portfolio, and continuing to rebalance it over time, you can maintain an even flow of retirement income to combat threats to your nest egg like longevity, inflation, time away from the workforce, or divorce.

3. Plan for Tax Efficiency

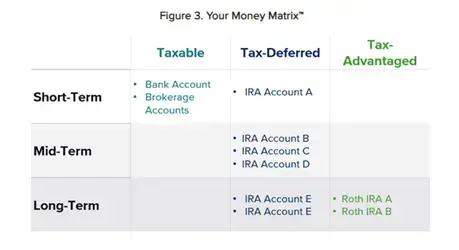

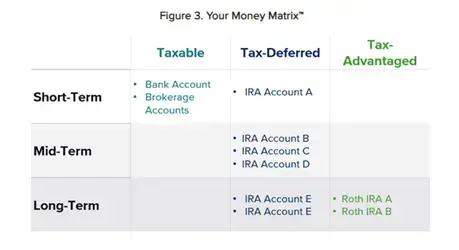

While many people realize the importance of diversifying their investments, not everyone understands that tax diversification is equally critical. There are three main tax “buckets” investments may fall into:

- Tax-deferred investment accounts delay your tax burden. Contributions and earnings are taxed once the money is withdrawn. At that point, you'll pay ordinary income tax rates on any distributions. Examples of these accounts include Traditional IRAs, 401(k)s, and 403(b)s.

- Tax-advantaged investment accounts reduce your future tax liability. That means you’ll pay tax upfront on any contributions you make but can withdraw the funds on a tax-free basis if certain conditions are met. Accounts like Roth IRAs and Roth 401(k)s are examples of tax-advantaged accounts.

- Taxable investment accounts are liquid and accessible but don't provide any long-term tax benefits. Their earnings and realized gains are taxable at year-end.

The goal here is to intentionally distribute your assets between various investment accounts that are taxed differently. That way, you can reduce your tax bill and ideally optimize the amount of money you have available to you during your retirement years.

4. Optimize Social Security

Two things that can negatively impact your retirement nest egg are longevity and inflation—outliving your retirement funds and having them depleted by the rising cost of goods and services. However, Social Security is a benefit adjusted for inflation. That makes planning for this powerful benefit even more important—particularly because the timing you choose to start claiming your benefit affects how much you’ll receive for the rest of your life.

Claiming earlier than full retirement age (FRA) will leave you with a permanently reduced benefit while waiting until you turn 70 qualifies you to receive the maximum lifetime benefit.

5. Expand Your Investing Knowledge

When it comes to maximizing your retirement savings, knowledge is power. Fortunately, a wealth of resources exists to help you enhance your financial literacy. Take some time to find some online educational resources geared towards your specific needs. Attend events focused specifically on topics related to women and wealth. Speak to other women you trust or to your financial advisor to get guidance and support. By arming yourself with investment knowledge, you’ll be better placed to make more informed retirement decisions.

6. Seek Comprehensive Financial Planning

As you plan for your retirement, you may find it difficult to walk alone. You already face several challenges, but seeking out the guidance of an experienced financial advisor can help ease your burden and ensure you’re on track to reach your retirement goals.

That said, not all financial advisors are created equal, and it's essential to understand what you're paying for. Working with someone like a Wealth Enhancement Group advisor who will craft a goal-oriented, comprehensive financial plan that considers every aspect of your financial life—from tax planning to insurance to estate planning—is a greater value than someone who charges the same amount but only advises on investments.

Lay the Foundation for a Secure Retirement

While the hurdles women encounter on the journey to retirement are real, they don’t have to deprive you of a secure retirement.

Our free, on-demand webinar, Retirement Planning for Women: 6 Critical Steps to a Confident Future, is packed with proven strategies tailored just for you. Wealth Enhancement Group advisors Nicole Webb and Mark Cortazzo will guide you as you navigate the world of savvy retirement planning.

In this webinar, you're not getting generic advice. You’ll have access to a coveted playbook—a roadmap to confidently navigate your unique retirement challenges. And that's just the beginning.

So, are you ready to empower yourself and claim the retirement you've always wanted? Then schedule time with a financial advisor to start your journey. You don't have to walk your path to prosperity alone.