Life happens. The reality is you may not always be there for your loved ones, but you can always take care of them. One of the best ways to do that financially is with life insurance.

That’s the thought behind the nonprofit organization Life Happens’ “Insure Your Love Month” campaign every February. The concept for their 2020 campaign is “A Promise Kept,” which asserts that life’s major milestones generally come with a promise: to love, cherish, guard and protect. And if something happens to you, are you able to keep that promise?

Do You Have Enough Life Insurance?

Undoubtedly, life insurance is an uncomfortable topic, but it’s an important conversation to have for the financial well-being of your loved ones. As the Life Happens campaign says, “the basic motivation behind life insurance is love”–although life insurance can’t change the pain of losing a loved one, it can be life-changing for those who survive.

Think about it–one of the most stressful events you can experience is the loss of a loved one, and life insurance can ease the financial stress associated with that loss when they need it most.

So how much life insurance do you need? Unfortunately, there’s no easy answer. The amount of coverage you “should” purchase depends on what you want the life insurance to accomplish. The best way to figure that out is with an analysis of your family and personal financial situation, along with your financial goals and objectives.

Depending on your family’s financial needs, your loved ones can use life insurance funds for a variety of circumstances such as:

- Replacing a portion or all of your income

- Covering the mortgage to keep your family in their home

- Paying for final expenses, including medical costs

- Paying off debt

- Establishing a college education fund

- Covering financial emergencies

Often, insurance offered through your employer is only equal to one years’ salary, give or take. You may have the option to purchase additional coverage through your employer, but keep in mind that often isn’t portable if you transition jobs to a new employer. Whether through your employer or individually, you may need to purchase additional coverage depending on your family’s financial goals and what you’d like your life insurance to cover.

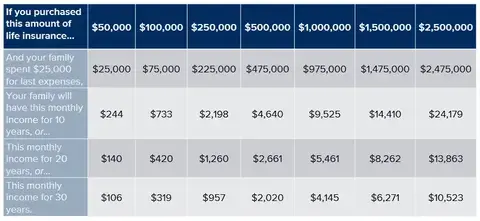

The chart below gives a good frame of reference for what different amounts of life insurance could mean for your family over the years.

For illustrative purposes only. Assumes 3% rate of return per annum on the Life Insurance Proceeds. All income amounts are shown pre-tax.

When Should You Purchase Life Insurance?

Insurers will primarily look at your age and health when determining your eligibility and monthly premium pricing for your life insurance policy. The younger and heathier you are, the longer you are likely to pay premiums, which means the insurer is taking on less risk to insure you. As such, there’s plenty of conventional wisdom floating around that suggests investing in life insurance as soon as possible to lock in lower premiums, even as young as when you’re in your 20s and 30s.

That said, affordable and high-quality coverage is available at any age. But no matter your age, if you have children or other financial dependents, there’s a good chance your family could benefit from the protection of a life insurance policy. Protecting your loved ones from the unexpected is an important part of a strong financial plan. The important thing is to choose the right life insurance for your budget and your needs.

Over the years, your needs, your family situation and your life goals will evolve. When that happens, it’s also time for you to re-evaluate the right type of insurance for you to ensure you are covered properly. Your financial advisor is there to provide some guidance in this process, based on your reality and your goals.

The opinions voiced in this article are for general information only and are not intended to provide specific advice or recommendations for any individual.

This article contains only general descriptions and is not a solicitation to sell any insurance product or security, nor is it intended as any financial or tax advice. For information about specific insurance needs or situations, please contact your insurance agent. State insurance laws and insurance underwriting rules may affect available coverage and costs. Guarantees are based on the claims paying ability of the issuing company.