Whether you're a young individual just starting a career path or a well-seasoned professional nearing retirement, developing a savvy tax strategy today can save you from some painful surprises down the road in retirement.

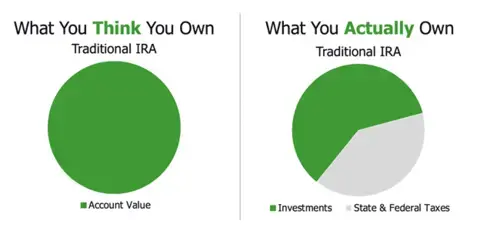

But becoming tax savvy is easier said than done, mainly because what you see in your account balance is not always what you get. Traditional Roth IRAs, and other tax-deferred accounts, are a great example of this.

Figure 1: Traditional IRA Before and After Taxes

Building the right tax strategy is all about knowing your options, the benefits and drawbacks of each, and how to best put everything together for your unique situation. To kick things off, let’s dive into tax diversification, a key concept on our path to understanding retirement tax planning.

What Is Tax Diversification?

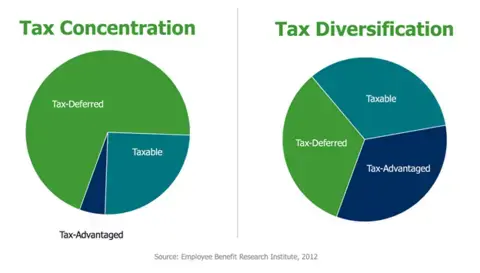

Tax diversification is intentionally distributing your assets between various investment accounts that are taxed differently. Much like diversifying an investment portfolio across different asset classes, tax diversification ensures you don't rely too much on a single type of investment account by spreading out how and when you need to pay taxes.

We have three primary investment account options: tax-deferred, tax-advantaged, and taxable.

- Tax-deferred investment accounts delay your tax burden. Contributions and earnings aren’t taxed until the money is withdrawn, at which point you’ll pay ordinary income tax rates on any distributions. Examples of these accounts include Traditional IRAs, 401(k)s, and 403(b)s.

- Tax-advantaged investment accounts reduce future tax liability by paying tax on contributions, and if certain conditions are met, distributions are tax-free. Accounts like Roth IRAs and Roth 401ks are examples of tax-advantaged accounts.

- Taxable investment accounts are liquid and accessible, but they don't provide any tax benefits described in the previous two categories. Their earnings and realized gains are taxable at year-end.

We recommend prioritizing "tax diversification" or intentionally spreading assets between the taxable, tax-deferred, and tax-advantaged buckets. This strategy allows a more even distribution of your tax burden throughout your life by allowing you to vary what sources you draw income from based on your circumstances.

Figure 2: Illustration of Tax Concentration and Tax Diversification

Unfortunately, most retirement planning often results in “tax concentration,” when distributions from different accounts predominantly fall into one of the same tax buckets. Many people keep most of their savings in tax-deferred accounts, primarily because employer retirement plans make it easy to do so, and the tax deductions provide an immediate benefit. This can result in unfavorable situations in which retirees are left paying taxes on a high amount of their retirement funds after they’ve stopped working.

To illustrate, consider an individual who allocated 70% of their retirement funds into Traditional IRA accounts. While this strategy may provide tax-deferred growth for a large chunk of their savings, the individual may be in for a shock when they need to pay ordinary income tax on most of their distributions after retirement, as shown in Figure 1. For some retirees, this amount could be high enough to force lifestyle changes over time.

The precise definition and proportions of “tax diversified” will depend on your unique circumstances, but no matter who you are, the steps to create tax diversification remain the same.

How to Become Tax Savvy?

At Wealth Enhancement Group, we’ve created a better approach to help you strategically fill your tax buckets called the Your Money Matrix™. This proprietary tool helps you tangibly visualize how you’ll get the money you need for your life.

To construct the Your Money Matrix, first plot three rows with the timeframes in which you’ll need money:

- The short-term: Money we need during the next five years. These should be low-risk investments.

- The medium-term: Money we need between six and ten years from now.

- The long-term: Money we may need more than ten years in the future. Since you don't need this money for at least ten years, these investments should be focused on growth.

These three rows already provide our process with a great insight: we will need money at every horizon we see in our future, no matter what. Taxation is one of life’s only certainties, so planning for it across these horizons can provide us with the peace of mind that we’ve taken a step towards providing for ourselves down the road.

The next step is to set up the columns of the Your Money Matrix. In our case, we are worried about tax diversification, so we are going to put our three primary options of investment accounts described earlier in the column headers:

- Taxable accounts: Brokerage and other liquid accounts with gains taxed at year-end.

- Tax-deferred investment accounts: No tax today, but distributions are taxed as ordinary income.

- Tax-advantaged investment accounts: No tax deduction on distributions, but withdrawals can be tax-free.

The Your Money Matrix comprises these three fillable rows and columns, which overlap to provide you with a grid. Next, to illustrate the process, we will populate the Your Money Matrix with a set of investment accounts from the perspective of a near-retiree considering when to take distributions from her different accounts.

Example: Tax Savvy Strategy in the Your Money Matrix

Michelle is 56 years old and has invested in various accounts to prepare for her retirement. She isn't sure when she'll stop working but thinks she'll want to within the next five to ten years. Michelle's advisor suggests using the Your Money Matrix to help her plan a tax-savvy strategy for retirement.

After the Your Money Matrix exercise, Michelle realizes her current situation is anything but diversified. Her employer retirement plan made it easier to invest in tax-deferred accounts. She also enjoyed reducing her taxable income by the amount she contributed to her 401(k). Because she followed that strategy throughout her career, she has considerably more money in tax-deferred accounts, with few leftovers for her tax-advantaged Roth account.

Next, Michelle's advisor runs some calculations to show the portion of her 401(k) account she needs to withdraw to cover taxes, and Michelle realizes she doesn't have as much to spend in retirement as she thought.

Michelle’s advisor suggests a few strategies to help her start working towards tax diversification:

- Re-allocate contributions. Michelle is doing an excellent job with the amount she is saving for retirement, but her advisor suggests she put more into tax-advantaged accounts and less into her 401(k). He advises her to contribute to her employer's 401(k) match, then invest the remaining amount into a Roth IRA.

- Build up your HSA. HSAs have not been discussed yet in this article, but they offer a double tax benefit. Funds in an HSA are not taxed when contributed, and withdrawals are tax-free as long as funds are used for qualified medical expenses. Michelle's advisor recommends she fully fund her HSA each year and avoid using it as much as possible so she can benefit from tax-free growth.

- Develop a Roth Conversion Roadmap. Once retired, Michelle may want to take advantage of Roth Conversions to create additional tax diversification. Roth conversions are described below, but they can be complicated, and it's best to have a multi-year plan in place.

How Roth IRA Conversions Can Help

A Roth IRA conversion (or Roth conversion) is a way to move money from a tax-deferred account like a Traditional IRA account into a Roth IRA account. At the time of conversion, income taxes are due on the amount converted, but the funds can grow tax-free.

The benefits of the Roth conversion for tax-concentrated individuals are straightforward. Instead of paying tax on the lion's share of your distributions during retirement, you'll now have the option to leverage the power of tax-advantaged accounts. Additionally, you'll no longer have to wonder as much about what income tax rates will look like in the future when you take distributions from the account.

While the concept is simple, successful execution is not. Timing is essential, as is understanding the implications on your overall financial situation. Once completed, a Roth conversion cannot be undone. Let's look at an example to illustrate why that might be problematic. Let's say you get a larger-than-expected bonus at work. You might decide to take some of those bonus dollars and use them to pay the tax on a Roth Conversion. But, come tax time, you realize that the bonus income combined with the Roth conversion amount bumped you into the next tax bracket, and you now owe Uncle Sam even more.

Working with an advisor experienced with Roth conversions is essential to help you decide when and how much you should convert. Ideally, you want to do Roth conversions in years where your income is lower to take advantage of lower tax rates while also considering your cash flow needs.

You Need to Be Tax Savvy

With retirement investing, you can’t afford not to be tax savvy. If you want to learn more about the tax strategies discussed in this article or how you can apply the Your Money Matrix to your unique situation, reach out to an advisor today and schedule a meeting.