Imagine driving a car without a basic understanding of the rules of the road, or even how to operate it. Scary thought.

Here’s another scary thought: Making financial decisions with minimal knowledge about investing, budgeting, and credit. The thing about this scary thought is that it's all too real.

America's Financial Literacy: Survey Says…

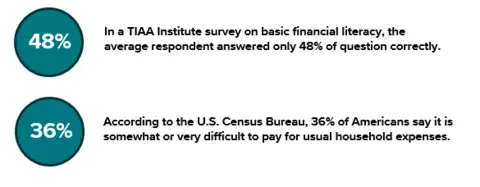

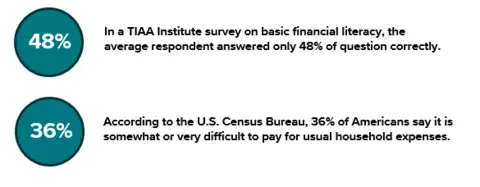

The TIAA Institute conducted a survey on Americans' financial literacy, asking 28 basic questions about retirement savings, debt management, budgeting, and other financial matters. The average respondent answered only about half of the questions correctly. Another survey, this time by the U.S. Census Bureau, found that over 36% of Americans say that it has been somewhat or very difficult to pay for usual household expenses in the last 7 days.

Image

They say that knowledge is power. If that's true, then too many Americans lack the power to control their financial futures. Financial success doesn't happen by accident. Instead, it's the outcome of a journey that starts with education.

The Lake Wobegon Effect

Garrison Keillor created the fictional town of Lake Wobegon for the radio program A Prairie Home Companion, hosted in St. Paul, Minnesota. In this program, Keillor told stories about the events that transpired in this fictional town to a wide audience.

Lake Wobegon had some notable characteristics. When describing the people of the town, Keillor said: "All the women are strong, all the men are good-looking, and the children are all above average." This line has since inspired the name for the so-called "Lake Wobegon Effect," which describes the human tendency for us to describe ourselves as above average.

There are a vast number of surveys and studies available that demonstrate the Lake Wobegon Effect. In each, researchers consistently find that we humans consistently believe we are above average, from children to adults.

Based on this belief, it only follows that we believe our financial understanding is above average. While you may truly be one who is above average in their financial acumen, this assumption has a fatal flaw: it discourages us from continuous learning in our ever-changing financial landscape.

Mitigating the Financial Literacy Crisis

We continuously learn and adapt in other areas of our lives; our financial education should be no exception. A significant gap in financial literacy can have a long-term impact on your financial future. Don't leave it to chance.

Acknowledging the need for ongoing education and support is the first step towards financial empowerment. The more informed we are, the more informed our decisions become. Fortunately, you have access to the tools you need to achieve greater financial literacy.

Take control of your financial future by arming yourself with the knowledge and support you need to thrive. Book a complimentary, no-obligation meeting with a financial advisor today and pave the way towards a future of financial security.