Inflation has been getting a lot of publicity recently—and for good reason. While we lucked out and had very minimal inflation over the last several years, low interest rates, rising debt levels, and an unprecedented amount of government stimulus have all combined to reverse that trend. And now, the threat of increased inflation has become a big concern for a lot of people.

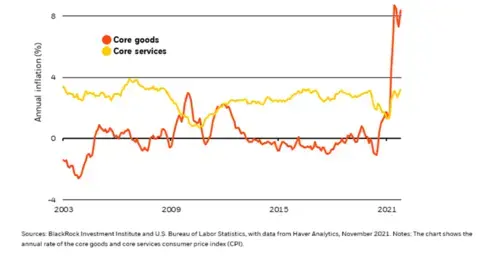

Figure 1 below shows the percent increase of inflation of core goods and services (basic goods/services, excluding food and energy) over the last decade and a half. Inflation typically hovers around 2 or 3% on a year-to-year basis, but it hit core goods hard in 2021, meaning the average cost of these types of goods has had a greater percent increase in the last year than it has in the last 20 years.

Figure 1. U.S. Core CPI

Put simply, as inflation rises, your money can’t do quite as much as it used to. If this trend continues, it could have a major effect on your retirement savings.

How Inflation Can Affect Your Retirement

Inflation is arguably the most frustrating threat to your retirement nest egg because it’s completely out of your control. You worked hard for your money, and you want it to work just as hard for you in retirement. But unchecked inflation has the potential to significantly weaken your retirement savings.

As mentioned before, year-to-year inflation typically hovers around 2 or 3%. This means that if something costs $1 today, the same item will likely cost around $1.03 next year. While that might not seem like a huge increase, over time, it makes a big difference when it comes to purchasing power. For example, let’s say you have $100 in your checking account. In 25 years, that $100 isn’t going anywhere, but at a steady 3% annual rate of inflation, that $100 will only be able to buy about half of what it can now.

It’s one thing to think about inflation in the abstract, but what about how it works in the real world? With 7 out of 10 Americans requiring some form of long-term care (LTC) in their lifetimes, LTC is a very real part of many peoples’ lives after they retire. In 2020, the national median cost of a private room in a nursing home facility was $8,821 a month. Assuming a 3% rate of inflation over the subsequent 10 years, that same room would jump to $11,855 a month in 2030. That’s an extra $36,408 a year you’d need to come up with to pay for the same room!

Additionally, people are living longer than ever before. It’s not out of the realm of possibility to think that you could need your retirement savings to last you 30 or more years. If we stick with our same private room in a nursing home facility, the median cost jumps to a whopping $21,411 a month in 2050—or nearly three times what it costs now! What you have saved up could get you through the first few years of retirement, but depending on the length of your retirement, it might not be enough.

How to Combat Inflation

The good news is there are things you can do to take on inflation. By implementing these five strategies, you can soften the blow of inflation and be better prepared down the road:

1. Don’t Just Save—Invest

Remember that $100 you put away in your checking account? It’s good that you’re saving, but that’s not enough. You also need your money to grow so it can potentially keep up with the rate of inflation. The only way to do that is to invest it in assets that have the potential to appreciate.

2. Diversification Will Be Key

It’s also not enough to simply invest; you should make sure your portfolio is well diversified between stocks, bonds, and other assets. Precious metals like gold and silver can be a useful hedge against inflation, but you should also look into things like Treasuries or real estate. Housing prices typically appreciate to keep pace with inflation, and as we’ve seen recently, the housing market also has the potential to take off unexpectedly.

3. Balance—And Rebalance—Your Portfolio

A balanced portfolio is one that has an appropriate split between historically steady and volatile assets. Stocks tend to be riskier but can potentially yield a greater reward, while bonds are usually steadier (though, it’s worth mentioning that neither is a sure thing). Traditionally, experts believed having 60% of your investments in stocks and 40% in bonds was the soundest strategy, but this 60/40 split has recently come into question.

As time goes on, the value of these investments will rise and fall, and your original split between stocks and bonds will likely shift, meaning you could be exposing yourself to unnecessary market risk. To give yourself the best chance to keep pace with inflation but not overextend yourself, you’ll want to make sure your portfolio is always balanced in a way that makes sense for your situation.

4. Don’t Forget About Time Horizons

What this means is you should put money into different accounts or assets based on when you plan on needing that money. For example, say you’re currently retired and simply need to pay for your lifestyle over the next five years. It makes sense to set aside a chunk of money and invest it in something that generally comes with less volatility, like bonds. Historically, an investment in bonds gives that money the opportunity to grow without being exposed to too much risk. But when you’re thinking about the money you’ll need 20 years down the road (maybe to pay for that LTC), you can invest it in something like stocks. You’ll be taking on greater risk, but the idea is that the reward will also be greater, which can allow you to keep pace with—or even surpass—the rate of inflation. Additionally, if the markets do end up taking a nosedive, the long-term money you have invested in stocks has a greater chance to recover over time than what you have in bonds, which can also help hedge against inflation.

5. Treasury Inflation-Protected Securities

Another option is to look into Treasury Inflation-Protected Securities (TIPS). With TIPS, the principal is adjusted semiannually for inflation based on the CPI, while a real rate of return is guaranteed by the U.S. Government. This means that unlike traditional bonds, TIPS limit the risk of inflation in your portfolio and help protect your future purchasing power. However, it’s important to note that TIPS are subject to market risk and significant interest rate risk, as their longer duration makes them more sensitive to price declines associated with higher interest rates.

Manage Inflation in Real Time

No one can say for certain what will happen with the economy over the next 10 months, much less the next 10 years. As we’ve seen in the last few years, things can change quickly. But while inflation isn’t a guarantee, it’s likely. In the 107 years between 1914 and 2021, there’s been at least some inflation in 94 of them, so it’s something you should expect and plan for.

It can be frustrating to work so hard for your retirement savings only to see it chipped away by inflation. If you want to institute any of the above strategies, or if you’re interested in learning about some more, reach out to a Wealth Enhancement Group advisor. Our specialists have decades of experience and have seen it all. They can help you combat inflation and get more out of your retirement savings.