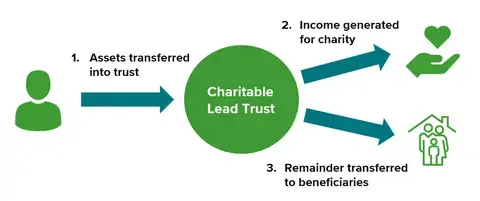

A charitable lead trust (CLT) is a popular gifting technique that combines charitable planning with tax planning. CLTs are split-interest trusts, meaning the beneficial interests are split between charitable purposes and non-charitable beneficiaries. The trust starts by paying a fixed annuity or unitrust amount to a charitable organization for the “lead” period, which can be a term of years or someone’s life. At the end of the lead period, the remainder is distributed to the non-charitable beneficiary.

How Does a Charitable Lead Trust Work?

A CLT is simply the inverse of a charitable remainder trust (CRT): Instead of providing an income stream to beneficiaries with the remainder going to charity, a CLT provides an income stream to the charity with the remainder going to individual beneficiaries. The income stream is provided for a set number of years or for the life of an individual.

Unlike CRTs, there is no restriction on how long the CLT can last or on how high or low the payout rate can be. By using a CLT, a person can provide an income stream to a charity, all while obtaining income or gift tax deductions.

What Are the Types of Charitable Lead Trusts?

There are two main types of CLTs: an annuity trust, or CLAT, and a unitrust, or CLUT. A CLAT provides an annuity to the charity that is a fixed sum, set at the inception of the trust. A CLUT provides an annual payment that is equal to a percentage of the annual fair market value of the trust.

In addition to deciding between an annuity or unitrust, the trust grantor has to decide whether the trust will be taxed as a grantor trust–meaning all trust income flows through to the grantor’s tax return–or a nongrantor trust–meaning the trust itself is taxed on its income. The income tax and estate tax deductions that are available to the grantor depend upon whether the CLT is a grantor or nongrantor trust. When using a grantor CLT, the grantor gets an income tax deduction for the present value of the expected payments to the charity. This can be useful when the grantor expects a year of high income and wants an immediate income tax deduction. When using a nongrantor CLT, the grantor does not receive an income tax deduction, but does receive a gift tax deduction for the present value of the expected payments to the charity.

The size of the income or gift tax deduction is based on the monthly IRS discount rate. The lower the discount rate, the higher the deduction. You can pair the discount rate with the payout rate to zero-out the gift taxes that would otherwise be due at the creation of the trust. In other words, the right combination of discount rate, trust term, and payout rate can produce a charitable deduction equal to 100% of the contribution. When the actual return earned by the trust is higher than the payout rate, the remainder does not decrease and is passed estate tax-free at the end of the term of the trust.

Is a Charitable Lead Trust Right for Me?

Like all trusts, a CLT is a contract between the grantor and the trustee. The grantor contributes the money and sets the terms of the trust, and the trustee agrees to carry out the terms of the trust and administer it for the beneficiaries. There are two types of beneficiaries in a CLT: the charitable income beneficiary, and the individual remainder beneficiary.

The donor can be any individual, corporation, partnership, LLC, or trust. However, the donor is generally an individual who is trying to utilize the charitable deduction. While the trustee can be any individual, including the grantor, it is not advisable for the grantor or grantor’s spouse to be the trustee of a nongrantor CLT. This is because of IRS rules regarding interested parties and self-dealing. Instead, the trust should name an institution to serve as trustee and maintain the administration of the trust, thus fulfilling all IRS regulations and maintaining the charitable deductions for the trust.

The charitable income beneficiary can be a public charity or a private foundation. Additionally, more than one charity can be the income beneficiary. It’s important to note that the income tax deduction available to grantor CLTs varies depending upon the type of charity. This is because the deduction is subject to the general adjusted gross income (AGI) limitation for charitable contributions of 30% for public charities or 20% for private foundations. Thus, you can only deduct up to the respective portion of your AGI. The unused portion of the deduction can be carried forward for up to five years of tax returns.

The remainder beneficiary can be an individual, corporation, partnership, LLC, or trust. There can be more than one remainder beneficiary, but at least one remainder beneficiary must not be a charity. Generally, for grantor CLTs, the grantor or grantor’s spouse is the beneficiary. In a nongrantor CLT, the beneficiaries are typically the grantor’s children or grandchildren, because the nongrantor trust functions to reduce estate and gift taxes on the remainder.

Although there are many trusts available for income and estate tax planning, when paired with charitable desires, the CLT is a useful trust that can help fulfill the grantor’s charitable intent while providing helpful tax reduction benefits.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

#1-05184775