Many people look to election results (and the presumed policy changes coming from the winner) as an indication of how the markets will perform, as well as the subsequent impact on their financial plan. This is especially true in presidential election years–but what role do elections actually play in regards to market performance? It might not be as correlated as you think.

Markets Don’t Favor One Political Party Over Another

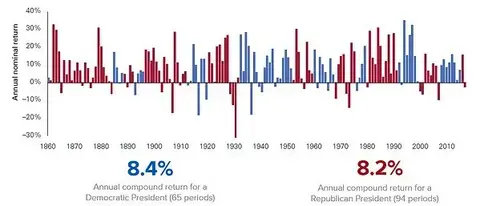

Conventional wisdom says that markets perform better when a Republican is in the White House because Republicans are seen as the “pro-business” party. As it turns out, which party is in the White House doesn’t tell us much about how the market will perform. Under Democratic leadership, the average annual compound return of a 60/40 portfolio is 8.4%. The average annual compound return for a 60/40 portfolio under Republican presidents is 8.2%. The 0.2% difference between the two is statistically insignificant.

Figure 1: Comparing Democratic and Republican Presidents

Source: Vanguard calculations based on data from Global Financial Data through 12/31/18.

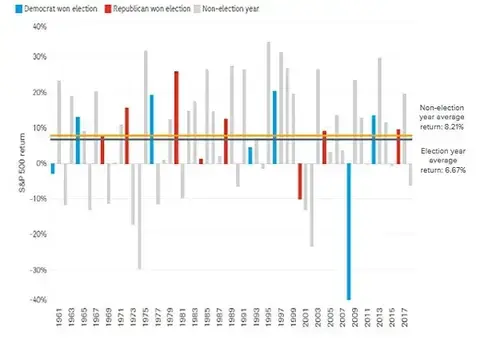

Another piece of conventional wisdom worth looking at is the idea that market returns in the year leading up to a presidential election tend to be below average. The theory is that a presidential election creates uncertainty for the future, markets dislike uncertainty, and therefore you can expect below average returns. The conventional wisdom is wrong. Election years can be more volatile, but market volatility measures price fluctuations–not price direction. The average return of the S&;P 500 in election years is similar to non-election years, with a difference of 1.6% (see Figure 2). If you dig-deeper to look at election year returns by sector, there is no discernable pattern–suggesting that election years do not, in general, impact sector performance. And, when looking at the same 60/40 portfolio as in Figure 1, there is not a statistically significant difference.

Figure 2: Election Year Returns

Source: Schwab Center for Financial Research with data provided by Morningstar, Inc.

This data highlights the fact that although the market inevitably experiences ups and downs from year to year, the winner of a presidential election actually has very little impact.

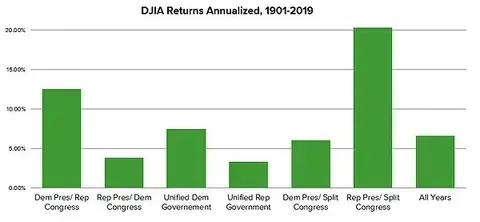

Markets Tend to Like Divided Government

Congressional elections, however, may have an impact on market performance. Remember, while we talk about “market returns” in the collective frequently, the market represents companies–specifically, the potential future profitability of companies. One thing that can have a detrimental impact on profitability is the need to comply with changing laws and regulations. So, markets tend to like periods of potential gridlock. On the other hand, when any one party is in power, that makes it easier to pass new policies quickly, and the markets react. You can see how control of congress impacts market returns in Figure 3.

Figure 3: How Control of Congress Impacts Markets

Source: Wealth Enhancement Advisory Services

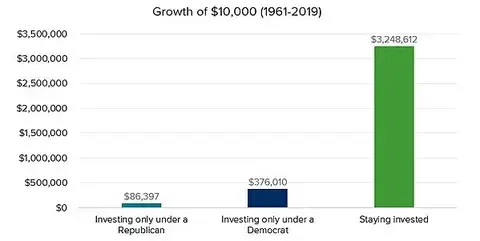

What Election Results Mean for Your Financial Plan

Generally speaking, investors should not allow elections to dictate their investment decisions. If you were to invest only under a Republican president or only under a Democratic president, you would be leaving a lot of money on the table. Markets tend to reward investors over the long term. Your investments and your financial plan should be based on your goals, your timeline and your risk tolerance, which shouldn’t change just because it’s an election year. On average, investors who stay the course and follow their financial plan, regardless of who is in office, will fare better than those who try to make market predictions.

Figure 4: Investing According to Party in Office

Source: Schwab Center for Financial Research with data provided by Morningstar, Inc.

With that in mind, there are still planning opportunities to take advantage of that you should discuss with your financial advisor. For example, taking advantage of historically low tax rates before tax policies change, or reviewing your estate plan as we continue to see legislation such as the SECURE Act that could have implications for your unique situation.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.