Watching a child graduate from college is one of the proudest moments in many parents’ lives. But before your kids put on those caps and gowns, they need to complete their education—and that can be costly.

Fortunately, programs exist to help you save for educational expenses. Two of the more popular options include Coverdell Education Savings Accounts (ESAs) and 529 college savings plans.

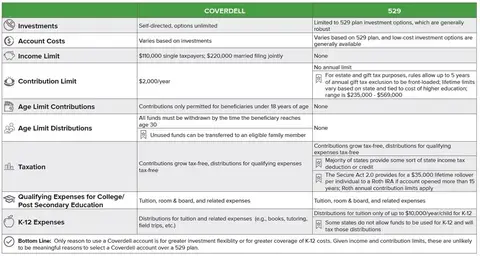

While both accounts offer tax advantages, they have some key differences that can affect your savings strategy. To help you select the education savings option that’s best for you, it can be useful to compare Coverdell ESAs vs. 529 plans.

What Is a Coverdell ESA?

Formerly known as an education IRA, a Coverdell ESA helps you save for qualified education expenses, including primary, secondary, and higher education costs. While contributions are limited to $2,000 per year per beneficiary and can only be made until the child turns 18, all those contributions grow on a tax-free basis. Money can also be withdrawn tax-free as long as it’s used to pay for qualified education expenses.

It's worth noting, however, that you can only open a Coverdell ESA if your modified adjusted gross income (MAGI) for 2023 is under $110,000 (or under $220,000 for married couples).

What Is a 529 College Savings Plan?

A 529 plan also enables families to save for education on a tax-free basis. Generally, these accounts are structured as either prepaid tuition plans or education savings plans.

A prepaid tuition plan lets you buy credits or units at participating colleges or universities at current tuition rates, shielding you from future tuition increases. For its part, an education savings plan lets you invest money over time to save up for future educational expenses. A 529 education savings plan operates similarly to a Coverdell ESA, offering tax-free growth and withdrawals for qualified educational expenses. However, there are some significant differences between the two.

How Do Coverdell ESAs and 529 Plans Differ?

Understanding the key differences between Coverdell ESAs and 529 plans can help you make a more informed decision about which option best meets your needs. At a high level, here are the primary differences between these two education savings plans:

- Income limits: Taxpayers whose taxable income is greater than $110,000 for single-filers—or $220,000 for married filing jointly—cannot contribute to a Coverdale ESA. In contrast, there are no income limitations for contributions to a 529 plan.

- Contribution limits: One of the main differences between Coverdell ESAs and 529 plans relates to the amount of money you’re allowed to invest annually. With a Coverdell ESA, you can put aside $2,000 per beneficiary per year. With a 529 plan, you can potentially contribute hundreds of thousands of dollars over time, depending on which state you’re in. That said, there are limits to the amount of money you can gift on a tax-free basis without eating into your lifetime estate and gift tax exemption amount. For 2023, that amount is $17,000.

- Investment options: Coverdell ESAs typically offer a more diverse range of investment options, giving you greater control over how your contributions are invested. While 529 plans also generally offer multiple investment options, those are limited to the choices provided by the specific plan.

- Age restrictions: With a Coverdell ESA, you can only contribute funds for children under the age of 18, and the account must be fully distributed before the beneficiary reaches the age of 30—unless the beneficiary has special needs. In contrast, 529 plans allow you to save for beneficiaries of any age, including yourself, and there are no age-based distribution requirements.

- Qualified expenses: Both Coverdell ESAs and 529 plans allow tax-free withdrawals for qualified education expenses. Generally, tuition, books, and room and board are considered qualified expenses for both accounts. However, with respect to K-12 expenses, 529 rules are more restrictive, covering only tuition up to $10,000/year—and even then, it depends on state regulations.

- Rollovers and transfers: Both 529 plans and Coverdell ESAs allow the beneficiary to be changed. Under new rules that take effect in 2024 and apply only to 529 Plans, a lifetime limit of up to $35,000 can be rolled both tax- and penalty-free to a Roth IRA if the 529 has been established at least 15 years.

- Ownership: Unlike 529 Plans, Coverdell ESAs are not revocable, meaning that they must be established solely for the benefit of the child. While the beneficiary may be changed, the parent is not the owner and cannot pull back contributions.

- State tax benefits: In some states, contributions to 529 plans are eligible for state income tax deductions or credits, providing an additional incentive for savers. That is not the case for Coverdell ESAs.

NOTE: Impact on financial aid: When it comes to financial aid, both Coverdell ESAs and 529 plans have a limited impact on eligibility. In the case of the FAFSA form, which is used on its own by the vast majority of institutions, grandparent-owned plan assets are not included in the eligibility calculation, and neither are plans owned by students who are not considered dependents. In addition, only up to 5.64% of the parent-owned plan assets are considered.

Frequently Asked Questions

Can I contribute to both a Coverdell ESA and a 529 plan? Yes, as long as you don’t exceed the contribution limits of each plan.

What happens if the beneficiary doesn’t use the funds? With a Coverdell ESA, you can change the beneficiary to another family member under the age of 30 to pay for their educational expenses. 529 plans also allow you to change your beneficiary designation so the funds can be used by another family member (including yourself) but without any age limitation. Since you are the owner of these funds, you can also pull the funds back to yourself for non-educational purposes, but they will be subject to income taxes and a 10% penalty.

Can both plans be used to cover K-12 educational expenses? Coverdell ESAs are more flexible in this regard, allowing you to use the funds for a broad range of primary education related expenses. 529 plans, in contrast, can only be used for tuition, and the amount is limited to $10,000 per year. And some states will tax those 529 plan distributions.

Can I withdraw funds for non-qualified expenses? With both educational savings plans, withdrawal of funds for non-qualified expenses will be subject to both income tax and a 10% (or higher) penalty.

Choosing Between a 529 Plan and Coverdell ESA

Deciding between a 529 plan and a Coverdell ESA depends on your specific financial goals and circumstances. If you are looking for more flexibility in investment choices and you don’t want to (or can’t) contribute more than $2,000 per year, a Coverdell ESA is likely the right choice. On the flip side, if you want higher contribution limits and fewer income level restrictions, a 529 plan may better meet your needs.

Education planning can be complex. If you’d like to learn more about the differences in contribution limits, investment options, tax treatment, and ownership rules between Coverdell ESAs and 529 college savings plans, reach out to your financial advisor for help determining which education savings program is right for you.