You work hard to save for retirement, and you want to make sure you’re doing everything you can to hopefully grow those savings. That’s why it’s important that you know how your financial advisor is adding value above and beyond what you might accomplish on your own. To do that, you’ll want to use information from independent, objective sources.

Do I Need a Financial Advisor?

Vanguard first published research on how much value the right advisor can add to your financial life in 2014. The study found that advisors could add value through relationship-oriented services (such as financial planning, discipline, and guidance).

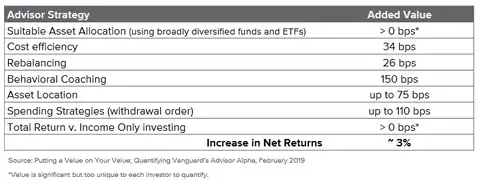

The latest edition of Vanguard’s research attempts to quantify the benefits that independent advisors can add by providing services like those outlined below, either individually or in combination. Although results vary by individual, Vanguard’s research suggests that independent financial advisors can add up to 3% in annual net returns through a framework focused on these wealth management principles:

Use these questions as a starting point to have a conversation with your advisor to make sure they’re adding the value you deserve. If you’re not seeing any of the added value discussed below, you might not have the right advisor for your circumstances.

What Kind of Behavioral Coaching Do You Provide?

Potential added value: up to 1.5%

Providing discipline and guidance could be the largest value-add you receive from a financial advisor. Because investing can naturally evoke emotions that facilitate short-term thinking, a financial advisor can help you maintain a long-term perspective and a disciplined approach to wealth management. Your advisor can help you avoid common financial mistakes by looking at the bigger picture to help make sure you don’t make long-term decisions based on short-term volatility. After all, you want to be on a pathway toward reaching your retirement goals without compromising the needs you have for today.

You’re not saving to hit a number; you have goals and values that are important to you, and your wealth is a tool to help you achieve those goals and live out your values. You also want to maintain the lifestyle you’re currently enjoying into retirement. That’s why we always start with a discussion of what you picture for your retirement so we can help you stay focused on aligning your financial goals with your values, even when the going gets tough. We believe that using your core values as a foundation for your financial plan leads to better decision-making that’s less prone to being swayed by emotional factors that come up when news headlines take a turn.

How Do I Implement a Sustainable Spending Strategy?

Potential added value: up to 1.1%

An appropriate withdrawal rate can make an enormous difference in the longevity of your savings. Figuring out which accounts to withdraw from and when can get complicated. Your financial advisor can help you develop a strategy to reduce the total taxes you’ll pay over the course of your retirement, which in turn can have a massive impact on the longevity of your portfolio.

It’s true that no financial advisor is going to be able to tell you exactly how much you’ll need saved for retirement. Our advisors can, however, provide you with a benchmark savings goal, a withdrawal strategy, ongoing advice and guidance each step of the way. Our goal is to help you live your desired lifestyle throughout retirement, while also working to maintain the legacy you want to leave. When you have the right advisor, you get answers to all the question you didn’t even know to ask.

What Does an Effective Asset Allocation Strategy Look Like?

Potential added value: up to 0.75%

Where you hold assets may be even more important than which assets you hold. Why does it matter? Because growth and earnings associated with your investments are taxed differently according to the type of account in which they’re held, and these taxes can have a significant impact on your end wealth.

When thinking about your investments, the key question is how much and when do you fill each tax bucket. Advisors can help you discern the ideal mix of taxable, tax-deferred and tax-advantaged accounts for your investments. Exact allocations of your assets between the three will depend on your circumstances. Our Roundtable™ team of advisors and specialists survey your plan from every angle to ensure you have the right balance. Because financial freedom begins with a plan you can trust from an advisor that you can trust.

Can You Help Employ Cost-Effective Investments?

Potential added value: up to 0.34%

Whether you're managing your own investments or working with an advisor, paying fees is a fact of life, and every dollar paid for management fees and trading costs eats into your potential return—put simply, when you pay less, you keep more. However, the fees from a financial advisor could be worth paying for in the long run. In addition to providing customized financial planning to help you work toward your goals, advisors at Wealth Enhancement Group can negotiate for lower transaction, expense ratios and custody fees compared to usual rates for individual investors.

Vanguard’s research shows that the value of a good financial advisor may cover their fees over time, particularly if the services you’re receiving provide long-term value, such as high-quality financial advice, retirement income planning and tax planning. On the other hand, commoditized services with lesser value like commissions, transaction fees and custodian fees should be mitigated as much as possible.

How Often Do You Rebalance to Maintain the Proper Allocation?

Potential added value: up to 0.26%

Once you’ve selected an asset allocation strategy to reach your goals, it’s important to maintain that allocation. The true benefit of rebalancing your portfolio is in making sure you’re not too heavily invested in one asset class over another, helping you balance returns and risk.

As investments produce different returns over time, your portfolio likely drifts from your target allocation. Historically, that drift tends to result in an allocation that is increasingly concentrated in stocks. For example, if your initial asset allocation is 60% stocks and 40% bonds, over time, that allocation may become 70/30—a more aggressive allocation than your original portfolio. Our investment management team regularly rebalances all portfolios to help you maintain your targeted asset allocation without taking on more risk than you’re comfortable having.

You are Unique. Your Financial Plan Should Be, Too

Every person’s financial situation is unique, and not all the strategies outlined here are right for everyone. Your plan should start with your goals, account for the progress you’ve made to-date and should consider your financial life from every angle. Ongoing planning with an advisor you trust will help you stay on track through life’s ups and downs. Our goal is to simplify your financial life. If you’d like to discuss your specific situation and how you may benefit from working with an advisor, please contact us today.

Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against loss.

Asset allocation does not ensure a profit or protect against a loss.