Everyone is different, so it stands to reason that everyone’s financial goals are different, too. But whether you want to retire early, pay for college for your children (or grandchildren), or buy a vacation home, you need a plan to get there. And while there’s no such thing as a one-size-fits-all financial plan, there are steps that everyone can take as they try to create a plan that’s suited to their individual needs.

Here are five steps for building your own unique financial action plan.

#1 Record Your Starting Point

It might seem like a no-brainer, but this is an often-overlooked part of the planning process. When creating a realistic and actionable financial plan, you need to be able to track your progress and measure it against a starting point. After all, how can you be sure you've reached your goal if you need to know where you're starting?

Start by taking a detailed inventory of your net worth, including "safe" money like your checking and savings accounts, investments like your IRAs and employer-sponsored 401(k)s, and other investments like real estate, art, valuable collectibles, etc. And remember to include liabilities like mortgages or any outstanding debt you might have.

Once you have all this information, record it, organize it and store it somewhere safe. You’ll need to be able to reference it often as you track your progress.

#2 Establish Your Goals

Don’t think of this step in terms of how much money you want to have. Financial plans aren’t about amassing money—they’re about living the life you want to live. Whatever you’re trying to accomplish with your financial plan should be based on goals for how you want to live your life.

As you think about this, use your values to help inform those goals. If you value family, maybe you want to spend more time with grandchildren. Perhaps that means purchasing a second home or condo in another state where your children and grandchildren live. If you value adventure, you may want to spend a month traveling overseas.

Deciphering how you would like to live out your dreams will help you determine the actionable steps you’ll need to take to make that dream a reality.

#3 Create a Plan

After you’ve taken inventory of your financials and established some goals, now’s the time to create an actual plan. You can set your time horizon—how long it will take to reach your goal. This will determine how much time you have to prepare, save, invest, etc.

Then determine what needs to be done to reach your goals within your established timeline. Where is the money going to come from? What investments make the most sense? How risky or conservative can you afford to be with your investments? How will taxes affect your income both now and in the future? By knowing what you have and how it will be taxed, you can be more organized in your planning and future savings plans.

Your plan should include the unexpected: Estate Planning and Insurance and Risk Management are key parts of being financially fit. What would happen to your things or your family if something happened to you?

Estate planning documents that may not have been a part of your financial inventory that should be a part of your financial plan going forward include a will, life insurance policies, trusts, and advanced care directives.

#4 Stay Disciplined

What use is a solid financial plan if you don't stick to it? This is arguably the most challenging step in the financial planning process because it’s not one thing you need to do one time—it’s hundreds of little things you need to do over the course of 5, 10 or even 20 years until you reach your goal(s).

Common sense says that the earlier you start to prepare (by saving and/or investing), the sooner you’ll meet your goals and the more money you’ll have. Financial planning is an ongoing process that will need adjustments as you go. However, one thing holds true throughout your financial life: consistency is key.

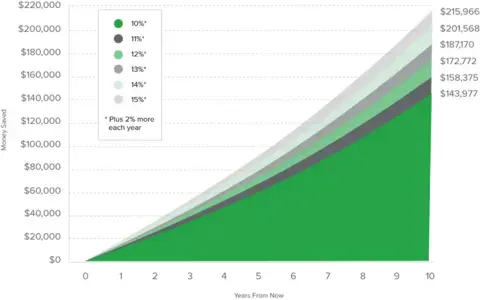

Thanks to compounding interest, the more you put away consistently early on in life, the more growth you'll likely see. For example, if you put away $2,000 a year at a 5% rate of return, in 20 years, you would have almost 2.5x as much money as you started with. That’s the beauty of compound interest.

Figure 1. Effect of Compounding Interest at Various Rates of Return

This hypothetical illustration assumes a $100,000 salary and a 6% annual rate of return.

If you are 50+ and trying to get on track for retirement, the IRS allows you to put away even more through Catch-Up Contributions. These contributions can be very beneficial as you enter the home stretch on your way to retirement.

So, get started on your plan, save early and often, and consistently follow through.

#5 Monitor Your Performance

Monitoring your progress is the best way to know that a plan is working. This means monitoring your statements, investment accounts, and savings goals.

It’s also important to remember that life isn’t linear. Unexpected bumps in the road are almost inevitable. Things like house repairs, medical emergencies, and policy changes (such as the passing of new tax legislation) will likely impact your financial plan and performance.

Luckily, the advisors at Wealth Enhancement Group are ready to help. With specialists in estate planning, investment management, tax planning, and more, we've seen almost every scenario and can help ensure your financial plan is covered. We can also help you stay on track toward reaching your financial goals and provide support if any adjustments are needed.

Schedule a meeting today to learn more about how we can help you build a financial action plan.