Financial planning is all about living the life you want to live. A comfortable retirement might be your ultimate goal, but what does that look like for you? Beyond that, how do you expect to get there?

The first step of any good action plan is a well-thought-out starting point, while the second step is establishing your financial goals. The third step is actually coming up with a plan. Once you know your starting and ending points, how do you plan to get from A to B?

The final part of our three-part series on creating a financial action plan is about developing and implementing the steps to get you where you want to be when you want to be there. This is the part of the process where the rubber meets the road, so the more heavy lifting you can do ahead of time, the smoother sailing you’ll have as you work to enact your plan.

Here are three tips for putting together an actionable financial plan.

Think About Your Time Horizon

When coming up with your financial plan, it helps to start at the end: You know where you want to be, but when do you want to be there? Said another way, when do you want to achieve your goals?

Many people might say something like, “As soon as possible,” or even, “As long as it takes.” By not setting a specific timeline for achieving your goals, you're doing yourself a disservice because that makes it nearly impossible to carry out a plan.

It would help if you had a time horizon to help you determine the steps required to achieve those goals. By setting a firm timeline, you know how long you have to prepare, save, invest, and plan. Start by asking yourself a few questions:

- Where is the money going to come from?

- How can I prepare now?

- Which investments make the most sense for my goals?

- What do we want to do earlier, and what can wait until later?

- How will taxes affect my assets in retirement?

With a concrete timeline in mind, you can answer these questions, which will become the basis of your financial action plan.

Let's say you're planning for retirement but don't want to retire for another 15 years. You can make smarter decisions with that timeline in mind by putting a specific timeline on your goals. For example, much of your retirement fund might sit in traditionally riskier investments like stocks, which are more susceptible to volatility in the short term. Still, they tend to be more predictable over long periods (like 15 years). You can then use past trends to make reasonable estimates about how your investments might grow over that time.

Get Strategic with Your Accounts

Once you have a timeline, you can take strategic steps to get where you want to be. And sure, it’s about saving and investing money, but it’s also about where you save and invest. It's about the types of accounts you own and how much money you put into them.

Mindful allocation is important because different types of accounts are taxed differently. Effectively planning for future taxes can save you thousands in retirement. All those savings help ensure you get enough money before passing away. After all, once you stop working, you might have another 30 years of living you need to pay for. This is where the Your Money Matrix™ can help.

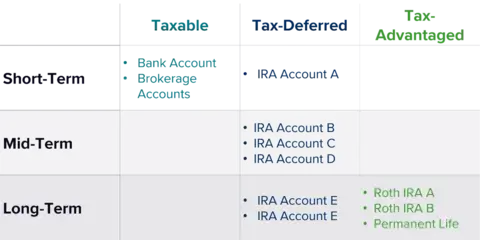

The Your Money Matrix is a proprietary tool at Wealth Enhancement Group that helps you plan your long-term financial strategy. To put this tool to work, you need to think about your finances in two different ways: timeframe and tax treatment.

Figure 1. Example of Your Money Matrix™

Timeframe

You have your time horizon for when you want to reach your goals, but timeframes are also crucial for figuring out how you’re going to get there. Start by grouping your money into what you think you’ll need in the short term (the next five years), the mid-term (6-10 years), and the long term (10 years and beyond). This not only gives you a clearer picture of how you can expect the money in these accounts to grow, but it also helps you visualize when you can tap into these funds.

Tax Treatment

Next, think about how each account is taxed. You should place the money you think you’ll need in the short term into taxable accounts because these accounts are completely liquid and easier to access. It would help if you had ample taxable investments to meet financial needs before age 59 ½. Otherwise, you’ll pay a 10% tax penalty if you take early withdrawals from tax-deferred or tax-advantaged accounts.

Tax-deferred accounts like Traditional IRAs, 401(k)s, and 403(b)s offer immediate tax deductions and tax-deferred growth, but remember that you have to pay taxes when you eventually withdraw. And thanks to the SECURE Act 2.0, required minimum distributions (RMDs) begin on these accounts at age 73.

Finally, you can put the money you will only need for a short time into tax-advantaged accounts like a Roth IRA or a health savings account (HSA). When you withdraw from a Roth account, there are no taxes due because they are funded with after-tax money, meaning these can save you a ton in income taxes during retirement. With HSAs, you get the double benefit of tax-free contributions and tax-free withdrawals for eligible medical expenses.

Prepare for the Unexpected

Your plan should also account for the unexpected: estate planning and life insurance are key to being financially fit. What will happen to your family and your assets if something happens to you?

A good estate plan has five key elements: a will, life insurance policies, trusts, power of attorney, and advanced care directives. If you're ready to draft documents, talk with your financial advisor or a qualified attorney to ensure your plans are official. If you've already prepared these documents, review them regularly so all your life changes are accounted for.

Planning for the unexpected with official legal documents and life insurance policies ensures that your loved ones will be protected and cared for after you're gone. Too often, individuals put off estate planning until it's too late. By planning well in advance, you can confirm that your money goes where you want it to. Whether naming beloved charities as beneficiaries for specific accounts or providing your children with durable assets, a properly designed estate plan will provide a quick, easy transition of your assets after your passing.

Make Your Financial Plan a Reality

Charting your time horizons, implementing the Your Money Matrix™, and preparing for the unexpected are the foundations of a strong, actionable financial plan. You're taking the preliminary steps to create a brighter financial future for yourself and your family by considering these factors and how they can play into your life.

The expert financial advisors at Wealth Enhancement Group are ready to help you develop your financial plan. If you want to get started, schedule a free meeting with a financial advisor to see how we can make your plans a reality.